Moody's Negative Outlook on U.S. Local Government Debt

by Michael Enriquez A few days ago, Moody's Investors Service announced that its outlook for the entire U.S. local government tax-backed and related ratings sector is negative. This is newsworthy not only for municipal bond investors but also for anyone following the U.S. recession. It marks the first time that Moody's issued an outlook on this entire sector, although it has issued ratings on the sector since 1914.

A few days ago, Moody's Investors Service announced that its outlook for the entire U.S. local government tax-backed and related ratings sector is negative. This is newsworthy not only for municipal bond investors but also for anyone following the U.S. recession. It marks the first time that Moody's issued an outlook on this entire sector, although it has issued ratings on the sector since 1914.Moody's Investors Service is one of the leading issuers of credit ratings. Investors use these ratings to gauge the risks of investing in debt assets. So, one might conclude that the analysts at Moody's are remarkably pessimistic about the impact that recessionary economic conditions will have on the ability of local governments in the U.S. to meet their debt obligations. This means that the risk of defaults on these debts has risen.

However, Moody's hedged its announcement by mentioning that credit pressures will vary significantly across locales due to differences in economic conditions, property assessment methods, and authority to raise revenue. The varying economic conditions can largely be explained by localities' exposure to industries hit particularly hard by the recession. These include real estate development, auto manufacturing, financial services, tourism, gaming, and general manufacturing. Differences in property tax systems will play a major role. Moody's report shows evidence that about 72% of local government tax revenue comes from property taxes. The bursting of the housing market bubble will bring declines in property tax revenue for most local governments because of falling home values.

Several of these governments might have the authority to increase property, sales, or income tax rates to raise revenue. Whether the elected officials running these localities are willing to do this is an open question. Moody's points out that taxpayers are worried about their own financial conditions and are highly resistant to increases in local taxes. Raising taxes in this environment will be unusually difficult for locally elected officials.

Cutting spending during the economic crisis will not be an attractive option either. In part, this is because many of these governments may face service mandates that prevent them from reducing service-related expenditures. An example of a service mandate is that a state government may mandate that local governments provide health services for the poor. Moody's analysts also reported that the demand for improved government services will make it that much more difficult for these governments to sustain healthy finances. Local officials may find that it is more palatable to default on their bonds rather than raise taxes or cut spending.

The credit crunch is also having a direct impact on local government finance. Moody's report states that access to credit will be more expensive for these governments than it had been in recent years. Moody's negative outlook announcement surely caused investors to demand greater yields on the municipal bonds trading in the credit markets. The company also warned that some localities are in such dire straits that they may be completely shut out of the credit markets.

Yet, the situation ought to be tenable for numerous governments. For instance, some well-managed localities increased their reserves during the boom years and were prudent with the funds generated during the real estate bubble. A simple example from portfolio theory can help show why investors may still be willing to buy the bonds of a cross-section of municipalities.

Suppose that a bond investor purchases three one-year bonds with different expected returns and probabilities of default. For simplicity, we'll assume that the investor is risk-neutral and the bonds pay nothing in the event of default. Bond A has a 25% probability of default this year but pays a coupon of 15% if it avoids default. Bond B has a 50% probability of default this year but pays a coupon of 20% if it avoids default. Bond C has a 75% probability of default this year but pays a coupon of 30% if it avoids default. Let's also assume that all the bonds have a face value of $100 each.

What is the investor's expected payoff from investing in this portfolio? It is

(0.75 × $115) + (0.5 × $120) + (0.25 × $130) =

$86.25 + $60 + $32.50 = $178.75

So, on average, an investor would be willing to pay less than 60% of face value on these bonds to make a positive expected return.

This example was purposefully simple, but from it you can see the advantage of diversification and the problem of gauging risk. If the probabilities of default end up being higher than estimated, the investor might lose money but will only lose all his money in the rare case that all bond issuers default. Yet, if the probabilities of default are lower than estimated, the investor might earn a high rate of return.

Discussion Questions

1. How does the bond portfolio example relate to the impact that mortgage-backed securities had on financial institutions? What must have happened to their default rates for them to become known as "toxic assets"?

2. If you had a large sum of money that you had to use for investment purposes, would you put together a portfolio of U.S. local government debt? If yes, why? If not, explain what your preferred investment would be.

3. Besides an economic recovery, what changes, if any, do you think are needed for local governments to avoid defaults in the future? How feasible are your proposed changes?

Labels: Finance, Global Economic Watch, Government, Lending, Political Economy, Taxes

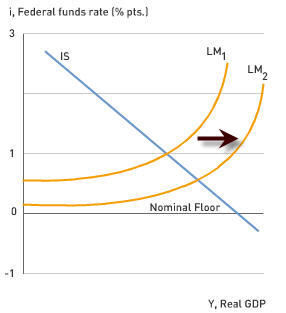

is the inflation rate:

is the inflation rate: