The Government as Drug Purchaser

by Joshua Gans

New research by Alan Garber, Charles Jones, and Aplia co-founder Paul Romer, suggests that a system of co-payments for health insurance might encourage a more socially desirable use of pharmaceutical drugs. Firms price patented drugs in a monopolistic way (patent protection typically applies for two decades). By behaving like monopolists, pharmaceutical firms tend to sell fewer patented drugs at higher prices--not necessarily the optimal outcome from a social standpoint. Some consumers are willing to pay more than the marginal cost of producing the patented drug, but monopoly pricing rations them out of the system. In short, the marginal cost of producing patented drugs is often far less than the marginal benefit to consumers. Expanding production would generate more benefits than costs, but monopoly pricing prevents the gains.

Garber, Jones, and Romer point out that patients covered by health insurance do not pay the full price for drugs. They share the cost with their insurers through a co-payment. With co-pay, consumers are more likely to purchase a drug than if they had to bear the full price. Monopoly drug pricing causes consumers to buy less. Insurance co-pay causes consumers to buy more. The counteracting forces of co-pay and monopoly pricing could lead to socially optimal drug consumption.

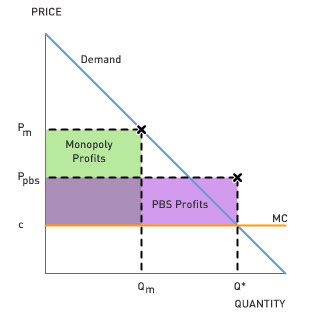

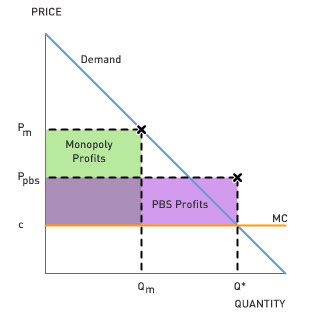

In Australia, the government offers co-payment for selected drugs. Australia enacted the Pharmaceutical Benefits Scheme (PBS) in the 1950s. Drugs covered by PBS are sold to patients at a price equivalent to the marginal cost of producing and distributing the drug. In the figure to the right, consumers backed by PBS will purchase drugs up to a quantity of Q*. Notice that this is the socially optimal level of drug usage. Q* is the quantity where demand intersects marginal cost; where the marginal benefit from consuming the drug exactly equals the marginal cost of producing it.

In Australia, the government offers co-payment for selected drugs. Australia enacted the Pharmaceutical Benefits Scheme (PBS) in the 1950s. Drugs covered by PBS are sold to patients at a price equivalent to the marginal cost of producing and distributing the drug. In the figure to the right, consumers backed by PBS will purchase drugs up to a quantity of Q*. Notice that this is the socially optimal level of drug usage. Q* is the quantity where demand intersects marginal cost; where the marginal benefit from consuming the drug exactly equals the marginal cost of producing it.

The drug companies receive a price that is negotiated with the Australian government (Ppbs). Drug companies always have a right to opt out of the scheme. In this case, they would earn monopoly profits as shaded on the figure [(Pm - c) x Qm)]. Because the drug companies can opt out, the government-negotiated price will need to be just sufficient to give the company the monopoly profit it would otherwise earn. This would be a price such as Ppbs. Notice that the drug companies earn a lower margin on each unit--(Ppbs - c) rather than (Pm - c)--but they sell many more units (Q* > Qm).

This is a win-win situation. Drug companies receive the profits they would in an unregulated market, but drug consumption is at its socially optimal level.

1. Suppose the Australian government had consumers share a fraction of the price charged by pharmaceutical companies, Ppbs, rather than their current fixed charge, c. Would they end up consuming more or less than if they paid a price of c?

2. The Australian government is concerned that its total expenditures on drugs have been growing as new treatments become available. Is this a legitimate concern?

3. Should the U.S. government consider playing a similar role as a purchaser of drugs? What impact would that have on the profits going to drug makers?

Joshua Gans is Professor of Economics at the Melbourne Business School, University of Melbourne. He has co-authored the Pacific Rim Edition of Mankiw's Principles of Economics and his own text, Core Economics for Managers (Thomson, 2005). He maintains his own blog at coreecon.blogspot.com.

Garber, Jones, and Romer point out that patients covered by health insurance do not pay the full price for drugs. They share the cost with their insurers through a co-payment. With co-pay, consumers are more likely to purchase a drug than if they had to bear the full price. Monopoly drug pricing causes consumers to buy less. Insurance co-pay causes consumers to buy more. The counteracting forces of co-pay and monopoly pricing could lead to socially optimal drug consumption.

In Australia, the government offers co-payment for selected drugs. Australia enacted the Pharmaceutical Benefits Scheme (PBS) in the 1950s. Drugs covered by PBS are sold to patients at a price equivalent to the marginal cost of producing and distributing the drug. In the figure to the right, consumers backed by PBS will purchase drugs up to a quantity of Q*. Notice that this is the socially optimal level of drug usage. Q* is the quantity where demand intersects marginal cost; where the marginal benefit from consuming the drug exactly equals the marginal cost of producing it.

In Australia, the government offers co-payment for selected drugs. Australia enacted the Pharmaceutical Benefits Scheme (PBS) in the 1950s. Drugs covered by PBS are sold to patients at a price equivalent to the marginal cost of producing and distributing the drug. In the figure to the right, consumers backed by PBS will purchase drugs up to a quantity of Q*. Notice that this is the socially optimal level of drug usage. Q* is the quantity where demand intersects marginal cost; where the marginal benefit from consuming the drug exactly equals the marginal cost of producing it.The drug companies receive a price that is negotiated with the Australian government (Ppbs). Drug companies always have a right to opt out of the scheme. In this case, they would earn monopoly profits as shaded on the figure [(Pm - c) x Qm)]. Because the drug companies can opt out, the government-negotiated price will need to be just sufficient to give the company the monopoly profit it would otherwise earn. This would be a price such as Ppbs. Notice that the drug companies earn a lower margin on each unit--(Ppbs - c) rather than (Pm - c)--but they sell many more units (Q* > Qm).

This is a win-win situation. Drug companies receive the profits they would in an unregulated market, but drug consumption is at its socially optimal level.

1. Suppose the Australian government had consumers share a fraction of the price charged by pharmaceutical companies, Ppbs, rather than their current fixed charge, c. Would they end up consuming more or less than if they paid a price of c?

2. The Australian government is concerned that its total expenditures on drugs have been growing as new treatments become available. Is this a legitimate concern?

3. Should the U.S. government consider playing a similar role as a purchaser of drugs? What impact would that have on the profits going to drug makers?

Joshua Gans is Professor of Economics at the Melbourne Business School, University of Melbourne. He has co-authored the Pacific Rim Edition of Mankiw's Principles of Economics and his own text, Core Economics for Managers (Thomson, 2005). He maintains his own blog at coreecon.blogspot.com.

0 Comments:

Post a Comment

<< Home