Saving America

by William Chiu

The U.S. trade deficit increased 2.4% between March and April 2006, which should be no surprise to our blog readers (archived entry: trade deficit and the negative saving rate). Some people point to China's fixed exchange rate or to the high oil prices for America's trade woes, but many macroeconomists contend that it is the lack of national saving that drives the trade deficit in the long run.

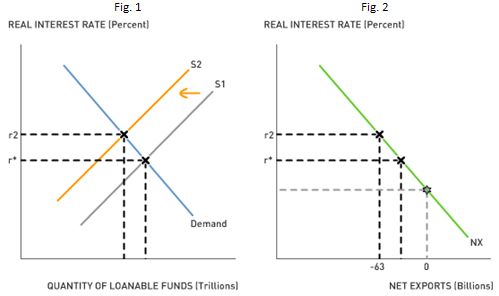

There are two markets that we have to consider when we examine the impact of saving on the trade deficit. First, consider the market for loanable funds, which determines the long-run real interest rate. Second, consider the relationship between the real interest rate and net exports. For simplicity, we're going to deal with absolute amounts (dollars) rather than relative amounts (percentages).

The market for loanable funds is where savers and lenders interact. Like any market, there's a supply and a demand. The demand for loanable funds consists of U.S. firms that want to borrow. The supply of loanable funds consists of U.S. firms, households, foreigners, and governments that want to lend. The price of loanable funds is the real interest rate, which is considered the "cost of borrowing" to borrowers and the "rate of return" to savers. The equilibrium real interest rate is where supply intersects demand, r*.

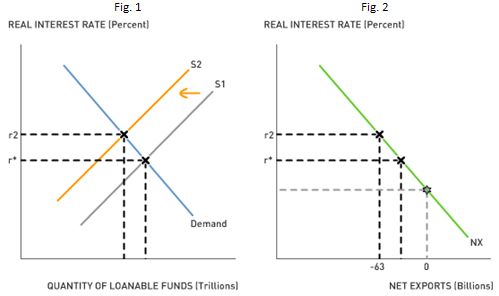

So what happens when the federal government increases its budget deficit and households decide to spend a larger share of their disposable income? An increase in the government budget deficit reduces public saving, and the increase in consumption reduces private saving. Put those two effects together, and we have a net decline in the supply of saving, which causes the equilibrium real interest rate to rise from r* to r2. (See Fig. 1.) A decrease in total saving in the United States pushes up the real interest rate. The real interest rate represents the rate of return for holding U.S. assets. If the real interest rate rises, then foreigners will want to buy more U.S. assets than they did before the rise. In order for foreigners to purchase U.S. assets, they must purchase U.S. dollars. Consequently, the demand for dollars increases, which increases the price of U.S. dollars. An appreciation of the U.S. currency, in real terms, will make U.S. exports less competitive and imports from foreign countries more attractive. An increase in the real interest rate causes a decrease in net exports and worsens the U.S. trade deficit. (See Fig. 2.)

A decrease in total saving in the United States pushes up the real interest rate. The real interest rate represents the rate of return for holding U.S. assets. If the real interest rate rises, then foreigners will want to buy more U.S. assets than they did before the rise. In order for foreigners to purchase U.S. assets, they must purchase U.S. dollars. Consequently, the demand for dollars increases, which increases the price of U.S. dollars. An appreciation of the U.S. currency, in real terms, will make U.S. exports less competitive and imports from foreign countries more attractive. An increase in the real interest rate causes a decrease in net exports and worsens the U.S. trade deficit. (See Fig. 2.)

Discussion Questions

1. According to our analysis, a fall in total saving actually increased the U.S. consumer's purchasing power of foreign goods and services (more U.S. imports) while it decreased the foreign consumer's purchasing power of U.S. goods and services (fewer U.S. exports). Is this an economic disaster or a sign that Americans are relatively wealthier than most people in the world?

2. A decrease in total saving increases the real interest rate, and a higher real interest rate increases foreign demand for U.S. assets, causing the price of the dollar--the real exchange rate--to rise. China purchases many U.S. assets in order to keep the value of its currency, the renminbi, relatively cheap compared to the dollar. In doing so, China intends to sustain American demand for Chinese-made goods. How does China's fixed nominal exchange rate policy affect the U.S. trade deficit in the long run?

3. If permanently higher oil prices reduce U.S. potential output, how does this affect national saving in the long run? How does this affect the trade deficit in the long run?

There are two markets that we have to consider when we examine the impact of saving on the trade deficit. First, consider the market for loanable funds, which determines the long-run real interest rate. Second, consider the relationship between the real interest rate and net exports. For simplicity, we're going to deal with absolute amounts (dollars) rather than relative amounts (percentages).

The market for loanable funds is where savers and lenders interact. Like any market, there's a supply and a demand. The demand for loanable funds consists of U.S. firms that want to borrow. The supply of loanable funds consists of U.S. firms, households, foreigners, and governments that want to lend. The price of loanable funds is the real interest rate, which is considered the "cost of borrowing" to borrowers and the "rate of return" to savers. The equilibrium real interest rate is where supply intersects demand, r*.

So what happens when the federal government increases its budget deficit and households decide to spend a larger share of their disposable income? An increase in the government budget deficit reduces public saving, and the increase in consumption reduces private saving. Put those two effects together, and we have a net decline in the supply of saving, which causes the equilibrium real interest rate to rise from r* to r2. (See Fig. 1.)

A decrease in total saving in the United States pushes up the real interest rate. The real interest rate represents the rate of return for holding U.S. assets. If the real interest rate rises, then foreigners will want to buy more U.S. assets than they did before the rise. In order for foreigners to purchase U.S. assets, they must purchase U.S. dollars. Consequently, the demand for dollars increases, which increases the price of U.S. dollars. An appreciation of the U.S. currency, in real terms, will make U.S. exports less competitive and imports from foreign countries more attractive. An increase in the real interest rate causes a decrease in net exports and worsens the U.S. trade deficit. (See Fig. 2.)

A decrease in total saving in the United States pushes up the real interest rate. The real interest rate represents the rate of return for holding U.S. assets. If the real interest rate rises, then foreigners will want to buy more U.S. assets than they did before the rise. In order for foreigners to purchase U.S. assets, they must purchase U.S. dollars. Consequently, the demand for dollars increases, which increases the price of U.S. dollars. An appreciation of the U.S. currency, in real terms, will make U.S. exports less competitive and imports from foreign countries more attractive. An increase in the real interest rate causes a decrease in net exports and worsens the U.S. trade deficit. (See Fig. 2.)Discussion Questions

1. According to our analysis, a fall in total saving actually increased the U.S. consumer's purchasing power of foreign goods and services (more U.S. imports) while it decreased the foreign consumer's purchasing power of U.S. goods and services (fewer U.S. exports). Is this an economic disaster or a sign that Americans are relatively wealthier than most people in the world?

2. A decrease in total saving increases the real interest rate, and a higher real interest rate increases foreign demand for U.S. assets, causing the price of the dollar--the real exchange rate--to rise. China purchases many U.S. assets in order to keep the value of its currency, the renminbi, relatively cheap compared to the dollar. In doing so, China intends to sustain American demand for Chinese-made goods. How does China's fixed nominal exchange rate policy affect the U.S. trade deficit in the long run?

3. If permanently higher oil prices reduce U.S. potential output, how does this affect national saving in the long run? How does this affect the trade deficit in the long run?

Labels: Exchange Rate, Interest Rate, Saving, Trade Deficit

2 Comments:

At 8:28 PM, March 19, 2007, Anonymous

said…

Anonymous

said…

This comment has been removed by a blog administrator.

At 2:11 PM, August 27, 2007, nick

said…

nick

said…

Economics students should now that what counts are real, not nominal, values. It may not be surprising that the trade deficit rose by 2.4%, but in real terms it rose only fractionally, and over the past year it has been shrinking as a percent of the U.S. economy.

Post a Comment

<< Home