Monetary Policy and Flexible Exchange Rates

by William Chiu The Federal Open Market Committee (FOMC), the monetary policy arm of the Federal Reserve, announced a 50-basis-point reduction in the target federal funds rate on Tuesday, September 18. The stock market soared in response to the rate cut because most market watchers were only expecting a 25-basis-point reduction. Read the FOMC statement for the reasons behind the rate cut. After the announcement, the U.S. dollar decreased in value against the euro, the British pound, the Japanese yen, and the Canadian dollar. This was no coincidence, and the reduction in the value of the dollar actually reinforces the Federal Reserve's goal of maintaining moderate economic growth.

The Federal Open Market Committee (FOMC), the monetary policy arm of the Federal Reserve, announced a 50-basis-point reduction in the target federal funds rate on Tuesday, September 18. The stock market soared in response to the rate cut because most market watchers were only expecting a 25-basis-point reduction. Read the FOMC statement for the reasons behind the rate cut. After the announcement, the U.S. dollar decreased in value against the euro, the British pound, the Japanese yen, and the Canadian dollar. This was no coincidence, and the reduction in the value of the dollar actually reinforces the Federal Reserve's goal of maintaining moderate economic growth.The federal funds rate is a benchmark for other interest rates in the United States. For simplicity, let's imagine for a moment that the federal funds rate is the only interest rate in the United States. If this is true, then the U.S. interest rate is also the dollar rate of return for holding U.S. assets. However, the United States is not the only country in the world. The European Union has its own interest rate that represents the euro rate of return for holding EU assets. For a given amount of volatility in asset prices, investors place their savings in assets that offer the best rate of return after adjusting for the exchange rate.

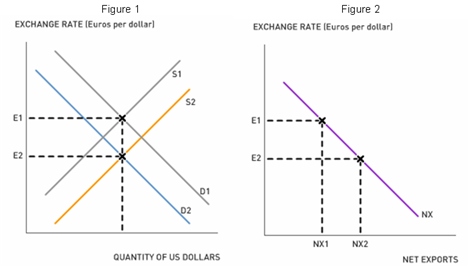

A reduction in the U.S. interest rate makes U.S. financial assets relatively less attractive than before because the EU interest rate has remained unchanged. U.S. investors will want to purchase more EU assets (i.e., there will be an increase in the supply of U.S. dollars), and EU investors will want to purchase fewer U.S. assets (i.e., there will be a decrease in the demand for U.S. dollars). Figure 1 shows the subsequent changes in the market for U.S. dollars.

A depreciation of the U.S. currency will make U.S. exports relatively inexpensive for foreigners while making imports from foreign countries relatively expensive for Americans. A decrease in the interest rate causes an increase in net exports and reduces the size of the U.S. trade deficit. Figure 2 shows the relationship between the exchange rate and net exports. Since net exports are a component of total spending in the U.S. economy, the Fed's rate cut provides two boosts to aggregate spending: (1) the rate cut stimulates consumption and investment because the cost of borrowing decreases; and (2) the rate cut stimulates net exports due to U.S. dollar depreciation. By cutting the target fed funds rate, the Fed intends to prop up spending and growth at a time when tightening credit conditions threaten to slow or reverse the growth of economic output.

A depreciation of the U.S. currency will make U.S. exports relatively inexpensive for foreigners while making imports from foreign countries relatively expensive for Americans. A decrease in the interest rate causes an increase in net exports and reduces the size of the U.S. trade deficit. Figure 2 shows the relationship between the exchange rate and net exports. Since net exports are a component of total spending in the U.S. economy, the Fed's rate cut provides two boosts to aggregate spending: (1) the rate cut stimulates consumption and investment because the cost of borrowing decreases; and (2) the rate cut stimulates net exports due to U.S. dollar depreciation. By cutting the target fed funds rate, the Fed intends to prop up spending and growth at a time when tightening credit conditions threaten to slow or reverse the growth of economic output.Discussion Questions

1. The previous analysis assumes that the United States and the European Union operate under a flexible exchange rate regime. Would the Fed be able to maintain moderate output growth after a severe shock, such as the subprime mortgage meltdown, if U.S. dollars were fixed to a currency such as the euro?

2. What if the Fed is wrong about the adverse effects of tightening credit conditions? What if growth would have continued at a moderate pace even without a rate cut? How would the decision to cut rates affect output and inflation in the short run and in the long run?

3. Suppose that at the next FOMC meeting on October 31, 2007, a jump in the inflation rate is reported. What would the FOMC do to the interest rate? How would this affect the exchange rate and net exports?

Labels: Exchange Rate, Interest Rate, Monetary Policy

0 Comments:

Post a Comment

<< Home