California's Foil Balloon Problem

by Brandon Fuller A helium-modified voice is good for a laugh, but the joke is risky. Inhale too much helium from the balloon and you'll pass out. It turns out that helium balloons can black out more than just the overzealous prankster. As recent news stories point out, foil helium balloons can get caught up in power lines and cause outages. California utilities reported hundreds of balloon-related outages last year: 211 for northern California's PG&E and 478 for southern California's Edison. California Senate Bill 1499 proposes to deal with the problem by banning foil balloons and fining violators. Though foil balloons can be a problem, a bit of economic analysis suggests that the heavy-handed ban may not be the best remedy.

A helium-modified voice is good for a laugh, but the joke is risky. Inhale too much helium from the balloon and you'll pass out. It turns out that helium balloons can black out more than just the overzealous prankster. As recent news stories point out, foil helium balloons can get caught up in power lines and cause outages. California utilities reported hundreds of balloon-related outages last year: 211 for northern California's PG&E and 478 for southern California's Edison. California Senate Bill 1499 proposes to deal with the problem by banning foil balloons and fining violators. Though foil balloons can be a problem, a bit of economic analysis suggests that the heavy-handed ban may not be the best remedy.By increasing the odds of costly power outages, helium balloon consumption imposes external costs on society. The vast majority of electricity consumers outside of the helium balloon market may nonetheless end up incurring some costs when errant balloons make their way into nearby power lines. Since helium balloon consumption imposes external costs, the social benefit of helium balloon consumption is considerably less than the private benefit. When the social value of a good is lower than the private value, there will be an inefficiently high level of consumption in the private market.

So rather than banning the balloons altogether, the California legislature may want to consider a corrective tax. Taxing the consumption of helium balloons would force buyers to internalize the heretofore external costs that the balloons impose on everyone else. The tax would reduce both foil balloons purchased and balloon-related power outages while giving buyers and sellers an incentive to shift toward less disruptive party favors.

To analyze the issue more closely, we need to define some costs and benefits in the market for foil balloons. Because helium balloon consumption generates external costs, the marginal social benefit from a helium balloon will be less than the marginal private benefit:

Marginal Social Benefit (MSB) = Marginal Private Benefit (MPB) – External Cost

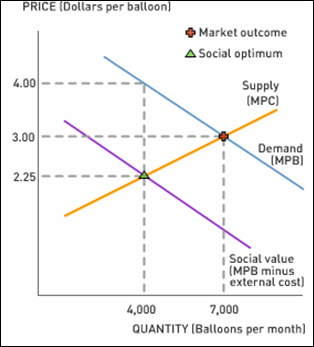

In the foil balloon market, the supply curve represents the marginal private cost (MPC) of selling balloons and the demand curve represents the marginal private benefit (MPB) of consuming balloons. The marginal social benefit (MSB) curve lies below the demand curve, since the social value of foil balloons incorporates the external costs. The socially optimal output level occurs where the marginal private cost of producing the balloons is equal to the marginal social benefit of consuming them—well below the market outcome at the intersection of our standard supply and demand curves. At points above the socially optimal output level, the marginal social benefit of the balloons will be less than the marginal cost of producing them. As a result, at least some of the current balloon consumption is inefficient.

Discussion Questions

1. According to our diagram of the hypothetical helium balloon market, what is the size of the tax necessary to achieve the socially optimal output level? Can you think of other markets where corrective taxes have been used or might be used to curb the external costs of consumption or production?

2. Is a ban more costly than a corrective tax in this case? Not all helium balloon buyers are careless with their purchase. Is the tax fair?

3. While a corrective tax has the potential to move a market closer to its social optimum, the use of government revenue from such taxes may be socially inefficient and wasteful. The correction of a market failure may simply beget government failure. Can you think of ways to prevent the government from wasting corrective tax revenues?

4. How would you go about estimating the external costs of helium balloon consumption?

5. What can you say about the price elasticity of the demand for and supply of helium balloons? Many party supply stores claim that any disruption to helium balloon sales will threaten jobs. What do you make of this?

1. According to our diagram of the hypothetical helium balloon market, what is the size of the tax necessary to achieve the socially optimal output level? Can you think of other markets where corrective taxes have been used or might be used to curb the external costs of consumption or production?

2. Is a ban more costly than a corrective tax in this case? Not all helium balloon buyers are careless with their purchase. Is the tax fair?

3. While a corrective tax has the potential to move a market closer to its social optimum, the use of government revenue from such taxes may be socially inefficient and wasteful. The correction of a market failure may simply beget government failure. Can you think of ways to prevent the government from wasting corrective tax revenues?

4. How would you go about estimating the external costs of helium balloon consumption?

5. What can you say about the price elasticity of the demand for and supply of helium balloons? Many party supply stores claim that any disruption to helium balloon sales will threaten jobs. What do you make of this?

Labels: Cost-Benefit Analysis, Elasticity, Externalities, Supply and Demand

0 Comments:

Post a Comment

<< Home