Oil Prices and Expectations

by Brandon Fuller Harvard economist Martin Feldstein's latest opinion piece in the Wall Street Journal argues that we can implement policies today that will impact the current price of oil. Current oil production responds to expectations about the future, Feldstein explains. Any significant change in expectations about the future price of oil will have an immediate impact on the current supply of oil. Broadly speaking, the expected price of oil changes for one of two reasons:

Harvard economist Martin Feldstein's latest opinion piece in the Wall Street Journal argues that we can implement policies today that will impact the current price of oil. Current oil production responds to expectations about the future, Feldstein explains. Any significant change in expectations about the future price of oil will have an immediate impact on the current supply of oil. Broadly speaking, the expected price of oil changes for one of two reasons:1. Changes in expectations about the growth of oil demand; and

2. Changes in expectations about the growth of oil supply.

How might changes in expected oil demand lead to higher current prices? As Feldstein points out, "when oil producers concluded that the demand for oil in China and some other countries will grow more rapidly in future years than they had previously expected, they inferred that the future price of oil would be higher than they had previously believed." If oil producers expect higher future prices for oil, they will curb production today (leave some oil in the ground) in hopes of extracting it at higher prices in the future. On the graph, the current supply of oil shifts to the left, to S1, causing the current price of oil to rise to P1 and the current quantity of oil to decline.

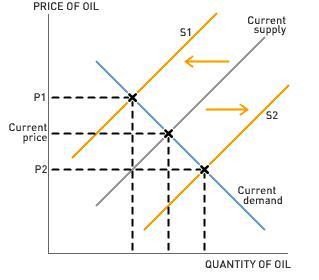

How might changes in expected oil demand lead to higher current prices? As Feldstein points out, "when oil producers concluded that the demand for oil in China and some other countries will grow more rapidly in future years than they had previously expected, they inferred that the future price of oil would be higher than they had previously believed." If oil producers expect higher future prices for oil, they will curb production today (leave some oil in the ground) in hopes of extracting it at higher prices in the future. On the graph, the current supply of oil shifts to the left, to S1, causing the current price of oil to rise to P1 and the current quantity of oil to decline.How might changes in expected oil supply lead to higher current prices? Again, from the editorial: "[C]redible reports about the future decline of oil production in Russia and in Mexico implied a higher future global price of oil." If producers expect oil supply growth to weaken in the future, the expected future price of oil rises, and oil producers leave some oil in the ground today in order to extract it at higher future prices. Once again, we'd expect the supply curve for oil to shift to the left, causing the price of oil to rise (to P1) and the quantity of oil to decline.

An increase in expected oil supply or a decrease in expected oil demand would lead to lower current oil prices. If oil producers think that future cars will be much more fuel-efficient than previously believed, they'd expect relatively weak growth in oil demand, and correspondingly lower future prices. In this case, producers respond by pumping more oil today in an effort to avoid lower future prices. Similarly, as Feldstein points out, "increasing the expected future supply of oil would also reduce today's price."

Discussion Questions

1. Although Feldstein points out that a significant increase in expectations about the future supply of oil would put downward pressure on today's price of oil, he does not explicitly endorse a policy of drilling in currently protected areas of the United States. The crucial question is whether or not future drilling in currently protected areas would have a large enough impact on worldwide oil supply to trigger production changes today. What do you think?

2. There's much discussion in the news about how to develop alternative sources of energy that would reduce the future demand for oil. What are some policies that would reduce the future demand for oil and oil-derived products, like gasoline? Would government commitment to these types of policies be credible enough to lower expectations of future oil prices?

3. Not all economists agree with Feldstein about the ability of current energy policies to impact current oil prices. Many (though not necessarily most) believe that there is very little the government can do to achieve lower oil prices in the next few months or years. Why might this be the case?

Labels: Cost-Benefit Analysis, Environment, Incentives, Supply and Demand

2 Comments:

At 3:09 PM, July 08, 2008, Don Coffin

said…

Don Coffin

said…

Note that nothing--NOTHING--in Feldstein's analysis relies on speculation as an explanation of how expectations can affect current oil prices. This is all, actually, fairly standard natural resource economics.

At 11:41 AM, August 14, 2008, Blog Sahibi

said…

Blog Sahibi

said…

There is one policy that will reduce oil prices significantly and quickly: we can impose a $4 gas tax per gallon which will significantly reduce the demand for oil. The tax revenue should be distributed equally among taxpayers to reduce the income effect of this new tax.

Ekonomix

http://turkeconomy.blogspot.com

Post a Comment

<< Home