Sacking Mugabe

by Brandon Fuller The path to growth remains elusive for many of the world's economies. Prescribing effective growth policies is exceedingly difficult. The unique features in each of the world's economies defy formulaic approaches to growth—it's not necessarily clear that Japan's path will work for Cambodia. Economic history offers a bit more clarity when it comes to what won't work. Of the more recent episodes of economic collapse, Zimbabwe's is perhaps the starkest. The Mugabe regime's mismanagement of the Zimbabwean economy reads like a step-by-step guide to economic ruin.

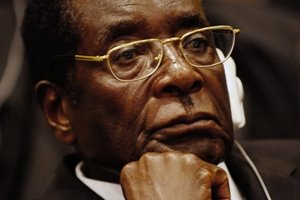

The path to growth remains elusive for many of the world's economies. Prescribing effective growth policies is exceedingly difficult. The unique features in each of the world's economies defy formulaic approaches to growth—it's not necessarily clear that Japan's path will work for Cambodia. Economic history offers a bit more clarity when it comes to what won't work. Of the more recent episodes of economic collapse, Zimbabwe's is perhaps the starkest. The Mugabe regime's mismanagement of the Zimbabwean economy reads like a step-by-step guide to economic ruin.In 2000, Zimbabwe's autocratic ruler, Robert Mugabe, implemented a clumsy and often violent land redistribution program. Mugabe forcefully seized white-owned farmland and gave it to black farmers unfamiliar with commercial farming practices. The absence of any cooperative knowledge transfer between white and black farmers led to a precipitous fall in agricultural output. The failure of the agricultural sector caused a severe contraction in overall economic output, creating massive unemployment. The collapsing economy sapped Mugabe's regime of the tax revenues necessary to pay soldiers and finance government outlays. An autocrat's reign is only as secure as his army is brutal—hungry, underpaid soldiers aren't much for intimidating political opponents or scaring the populace into submission. To maintain his government's outlays, Mugabe turned to borrowing. Of course, the loans would eventually need to be repaid. Lacking the tax base to repay the loans, the government resorted to the capstone of many economic disasters: printing money.

The results were predictable: hyperinflation reached roughly 4 million percent per year as of June 2008. At these levels of inflation, even the most mundane daily transactions involve considerable uncertainty and frustration. Mugabe's response to the hyperinflation that he himself initiated could not have been worse. The government imposed price ceilings, threatening to jail shop owners if they charged more than the official price. The price ceilings led to massive shortages of necessities like bread and milk. Many firms shut down production, escalating an already high unemployment rate.

You don't have to be an economist to recognize the first step to improving Zimbabwe’s economy: get rid of Mugabe. But removing Mugabe from power is easier said than done. Opposition presidential candidate Morgan Tsvangirai gave it an impressive go during this year's elections, but widespread violence against opposition supporters caused Tsvangirai to withdraw from the presidential run-off. At this point, Mugabe remains president.

Discussion Questions

1. Mugabe is 84 years old—why doesn't he just step down? Charlayne Hunter-Gault's article in The Root suggests that Mugabe has strong incentives to maintain his grip on power given the fate of other overthrown tyrants. Hunter-Gault raises an interesting dilemma for freedom-lovers all over the world: we want to get rid of brutal dictators, but the dictators may do everything they can to retain power precisely because they fear what we'll do to them once they're out of office. Should we offer Mugabe amnesty just to get him to step down?

2. In a recent Wall Street Journal editorial, former World Bank president and U.S. Deputy Secretary of Defense Paul Wolfowitz suggests a way to pressure Mugabe out of office. Wolfowitz calls on the international community to very publicly declare promises of aid and debt relief for Zimbabwe under the condition that Mugabe is removed from office. Do you think this strategy would succeed?

3. Mugabe's land redistribution program was catastrophic for Zimbabwe's economy, but as this NPR story points out, several neighboring countries attempted to benefit from the displacement of white farmers in Zimbabwe. How could the Zimbabwean government have balanced the goals of efficiency of the farming sector and equity for the black population that suffered a history of oppression by a ruling white minority?

Labels: Economic Development, Economic Growth, Inflation, Political Economy

0 Comments:

Post a Comment

<< Home