Maccaeconomics

by Ryan Knapp In an earlier post, I commented that I loved Radiohead. And I do, but I LOVE the Beatles. I hope you can appreciate the difference. Think about someone you know who is really obsessed with a band. Now multiply that by 20. That's how much I love the Beatles.

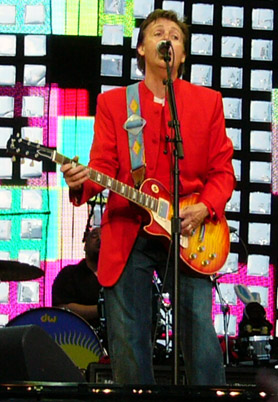

In an earlier post, I commented that I loved Radiohead. And I do, but I LOVE the Beatles. I hope you can appreciate the difference. Think about someone you know who is really obsessed with a band. Now multiply that by 20. That's how much I love the Beatles.So when I heard about Paul McCartney's intent to play a 4,000-seat venue in Las Vegas this April, one of the smallest public shows since he was backed by Pete Best at the Cavern Club, tears nearly welled up in my eyes. I enlisted the help of friends and family to get tickets online at the moment they became available. Much to my everlasting despair, we were unsuccessful, and I remain ticketless.

Claire, a friend here at Aplia who shares my obsession*, was also trying for tickets that afternoon. She, however, was successful.

There's a book that I recently read that gives good insight on my dilemma: Dan Ariely's Predictably Irrational. In this excellent book, Ariely details his research on what economists call "the endowment effect." The endowment effect states that the value someone places on a good increases when it comes under his ownership. The person would require more to give up a good than he would be willing to pay to receive it. This is in opposition to standard economic theory which would state that these two values should be equal when the good has a functioning market.

Ariely's experiment (PDF) found that students who had won a random lottery for Duke basketball tickets valued their tickets 14 times higher than students who lost the lottery. I found this interesting, and I wanted to see if the endowment effect would hold true for Claire and me, two equally obsessed McCartney fans who were on the opposite side of luck that Saturday afternoon.

How much would I pay for a ticket? Well, I guess it's less than $700, since that is the price on the secondhand market right now, and I haven't made a purchase. Now, how much would Claire require to relinquish her seat to me? See our instant messenger chat below where I asked for the sale:

Knapington: how much would i have to pay you to give up your ticket to Paul, assuming you couldn't re-buy another ticket with the funds?

Claire E: i really don't know if i'd take money--i really want to see paul

Knapington: so if i wrote down $1,000 and handed it to you, you'd say no?

Claire E: I'd say no

Knapington: what if I wrote $5,000

Claire E: nope. it would have to be at least $15,000 - because then i couldn't justify walking away

Knapington: so literally if I wrote a check for $10,000 and offered it to you right now, you'd say no thanks?

So perhaps she was exaggerating a bit—I eventually talked her down to $10,000, but that was as low as she'd hypothetically go. How could two people who at one point equally valued these tickets (each of us said before the sale that we would pay no more than $700 per ticket) hold such different values for the tickets after the fact?

Discussion Questions

1. 2008 was a remarkably bad year for most stocks. If you could sell all of your portfolio of stocks today, would you buy the same stocks again? If not, what keeps you holding on to those that you already own?

2. Think about the recent downturn in the housing market. Many homeowners looking (or needing) to get out of a mortgage they have difficulty affording end up pricing their home at the value they place on the home. Unfortunately, this price is often higher than any reasonable house-hunter would be willing to pay, particularly in current market conditions. How will this affect the homeowner? How will this behavior affect the housing market in general?

3. Can you think of other examples where the endowment effect might keep markets from adjusting as quickly as they otherwise would?

4. Suppose that Ryan is willing to pay $650 for the McCartney ticket while Claire values her ticket at $10,000. How do these figures relate to Dan Ariely's experiment? What if Ryan were willing to pay only $400 for the McCartney ticket?

* After working at Aplia together for some time, we stumbled upon our common obsession, and in our discovery, also realized that we had met each other at a Paul McCartney concert three years prior, and had a 20 minute conversation. Weird.

1 Comments:

At 11:33 AM, March 06, 2009, Milton Recht

said…

Milton Recht

said…

It called conditional expected value, which is related to the conditional probabilities of the events of selling prior to buying the ticket (selling conditional on buying the ticket), buying the ticket and selling after buying the ticket.

Not at all difficult to come up with probabilities and value of the ticket that would make the selling price after the fact higher than before owning the ticket.

Post a Comment

<< Home