Not-So-Cheap Chinese Labor

by Brandon Fuller "We're bullish on Vietnam."

"We're bullish on Vietnam."So says Hong Liang, an economist at Goldman Sachs responsible for tracking labor costs in China. A recent New York Times article reports that China's factories can no longer attract a surfeit of low-skilled workers at rock bottom wages. As a result, factory managers hoping to draw labor must offer better working conditions, higher wages, and more benefits. Although a challenge to factory managers, rising labor costs mean better opportunities for low-skilled workers in China and, as Ms. Hong's comment suggests, workers and managers in other economies. The relative stability of labor costs in Vietnam, India, and Bangladesh provide an appealing alternative for international manufacturers concerned by China's rising wages.

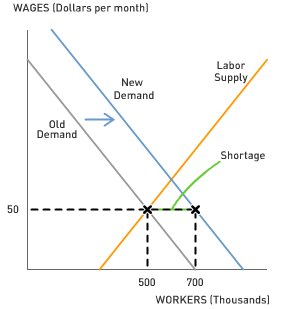

Where did the shortages come from? Over the past decade, cheap labor caused lots of companies to build factories in China. China's stock of capital surged with all of the foreign investment. The increase in the capital stock, in turn, increased the demand for labor, as shown in the graph at upper-right. At the old wage, only 500,000 people would be willing to work, but factories would want to hire 700,000 workers. So there's a shortage of 200,000 workers.

Although temporary labor shortages exist in China, there's no reason to expect them to persist in the long-term. The shortages arise because factories wish to hire lots of help on the cheap but more and more workers say "no thanks" to the low wage rates that prevailed for the past few years. The shortage of willing workers at old pay rates puts upward pressure on wages and non-wage benefits as employers scramble to attract more help. Once wages reach their new equilibrium, though, the shortages will disappear.

Why have Chinese workers become more selective? The Times article points to several reasons, including the inward movement of factories to more rural locales, the government's rural development push, an aging labor force, and a rapid increase in college enrollment.

1. By how much have minimum wages increased in big cities like Shenzhen, Beijing, and Shanghai? How do wages for workers in large factories operated on behalf of multinational corporations compare to minimum wages in China?

2. Workers who migrate from the countryside to large industrial centers face opportunity costs: in order to earn higher factory wages in the city they forgo working closer to their homes and families. As the Chinese government reduces farm taxes and encourages economic development inland, the number of rural job opportunities increases. How does inland economic development alter the opportunity costs faced by would-be migrant workers?

3. Other than wage hikes, what are companies like the Wahaha Group doing to attract migrant workers?

4. The declining share of young workers in the labor force is due in part to the rising number of young people who opt for higher education rather than the labor force. By how much did China's university and college enrollment rate increase between 1999 and 2005? How does the falling share of young workers in the labor force affect the supply of low-skilled factory workers? How does the demographic shift affect wages for low-skilled workers?

5. The article mentions that rising labor costs in China will shift the country's international trade flows. How will rising wages and benefits affect the Chinese demand for imports from countries like the United States? As rising labor costs lead to higher production costs, the prices for Chinese-made goods may rise. How will rising prices in China affect American demand for Chinese exports?

Topics: Labor markets and unemployment, International economics, China

1 Comments:

At 5:41 PM, April 12, 2006, Chris Buzzard

said…

Chris Buzzard

said…

At least partly due to the influx of investment capital and creation of jobs, Vietnam's stock index is up 60% this year and is expected to double by the end of the year. This CNNMoney article notes that Vietnam's economy grew by 8.4% last year and the privatization movement is growing.

Sounds like there is good reason to be bullish!

Post a Comment

<< Home