A Tale of Two Dragons: China's Trade Surplus and Inflation

by William Chiu In Chinese mythology, dragons can bring prosperity or destruction to villages and empires. China currently faces two dragons: the trade surplus that brings prosperity to Chinese manufacturers and urban workers, and inflation, which threatens China's price stability. Bloomberg reports that China's trade surplus might be fueling China's inflation problems.

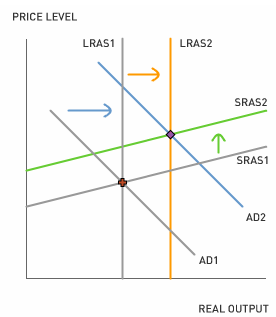

In Chinese mythology, dragons can bring prosperity or destruction to villages and empires. China currently faces two dragons: the trade surplus that brings prosperity to Chinese manufacturers and urban workers, and inflation, which threatens China's price stability. Bloomberg reports that China's trade surplus might be fueling China's inflation problems.One possible explanation is that the increase in the trade surplus outpaces the increase in potential output. Net exports are one component of aggregate demand in China. An increase in net exports pushes the aggregate demand curve to the right. Potential output increases as China utilizes more of its work-force (labor-intensive growth) and increases its capital stock (capital-intensive growth). The graph below shows that the increase in potential output (LRAS1 to LRAS2) is less than the increase in aggregate demand (AD1 to AD2). Whenever the increase in aggregate demand exceeds the increase in potential output, inflation is sure to follow (for example, from SRAS1 to SRAS2).

1. China maintains a relatively fixed nominal exchange rate between the yuan and the U.S. dollar (nominal exchange rate = 8 yuan per U.S. dollar). The real exchange rate is the nominal exchange rate times the ratio between the U.S. price level and the Chinese price level. The real exchange rate also represents the cost of U.S. goods and services relative to Chinese goods and services. How does an increase in China's inflation rate affect the real exchange rate?

1. China maintains a relatively fixed nominal exchange rate between the yuan and the U.S. dollar (nominal exchange rate = 8 yuan per U.S. dollar). The real exchange rate is the nominal exchange rate times the ratio between the U.S. price level and the Chinese price level. The real exchange rate also represents the cost of U.S. goods and services relative to Chinese goods and services. How does an increase in China's inflation rate affect the real exchange rate?2. How does an increase in China's inflation rate affect the trade balance between the United States and China?

3. The People's Bank of China often keeps its nominal interest rate equal to the United States' nominal interest rate in order to maintain the fixed nominal exchange rate (interest rate parity). Can the Bank of China choose to fight inflation and keep the nominal exchange rate fixed?

Labels: AD-AS Model, Exchange Rate, Inflation, International Economics, Trade Deficit, Trade Surplus

3 Comments:

At 9:25 AM, July 31, 2006, William Chiu

said…

William Chiu

said…

Thanks. Corrected.

At 11:53 PM, August 21, 2006, William Chiu

said…

William Chiu

said…

An alternative approach that explains China's increasing inflation rate is the quantity theory of money.

Money Supply x Velocity of Money = Price Level x Potential Output

MV = PY

Or, in percent change form,

% change in M + % change in V = % change in P + % change in Y

m + v = inflation + y

inflation = m + v - y

Hence there are two sources of inflation--money growth and velocity growth. And there is one source of deflation--output growth.

If the change in (m + v) exceeds the change in y, then the inflation rate will increase.

At 11:34 PM, April 30, 2008, Unknown

said…

Unknown

said…

Oil prices ease ahead of U.S. Federal Reserve rate decision

BY D SHEPPARD

LONDON,ENGLAND

The most debatable topic from last few years is the rising oil prices. since 9/11

and war on Iraq world oil prices rose tremendously. the rising inflation and the

weakening of dollar is causing the prices of commodities to go up. this article is

taken from thomson financial on April 30 2008.

Oil fell on Wednesday, extending crude's sharp sell-off as the dollar strengthens

ahead of the Federal Reserve interest rate decision later today .The Fed is widely

expected to cut rates by 25 basis points to 2.0 percent , which would typically

weaken the dollar and boost commodities. However, rate setters in the world's

largest economy are expected to signal a desire to hold rates there for the time

being. That anticipation is lending the dollar support and reducing the appeal of

commodities priced in the greenback.' A dollar rally could likely derail the short

dollar/long commodities play that has been working so well for much of the

year,' said MF Global analyst Ed Meir. New York-traded West Texas Intermediate

crude for June delivery dropped to an intraday low of $114.86 before firming to

$115.40 by 12:20 p.m., a 23-cent decline from T uesday's close. Meanwhile,

London Brent crude for June delivery fell 18 cents to $113.25. Supply concerns,

which boosted oil prices to within a few cents of $120 a barrel earlier this

week, have also eased. Falling demand in the United States has dealt a further

blow to prices, with revised figures released by the Energy Information

Administration (EIA) yesterday showing gasoline demand in February was 7

percent lower than the year before.

Some of the drop in demand may have been due to the weather, some may be

due to the price level, and some may be due to the slowing economy. Analysts

polled by Thomson Financial News expect to see a rise in crude inventories of

1.1 million barrels, while distillate stocks are expected to be up by 830,000

barrels. While this could further weigh on prices, expectations for a 625,000-barrel

drop in gasoline inventories could lend support. according to my reading the oil

prices will come down to $80 a barrel and thats what we all want it to be.

Post a Comment

<< Home