Oil Shock, Part II: The Macroeconomic View

by William Chiu Microeconomists examine how the BP oil field shutdown affects oil prices, the behavior of automobile drivers, and profitability of particular industries. Oil Shock, Part I showed that the oil field shutdown raises the price of oil which reduces the profitability of many firms.

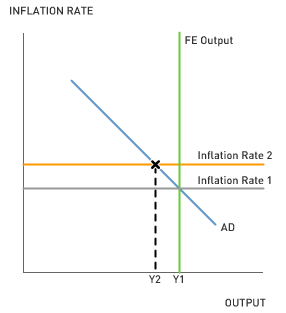

Microeconomists examine how the BP oil field shutdown affects oil prices, the behavior of automobile drivers, and profitability of particular industries. Oil Shock, Part I showed that the oil field shutdown raises the price of oil which reduces the profitability of many firms.Macroeconomists, on the other hand, examine the economy-wide effects such as how a sharp rise in oil prices affects inflation, output, and unemployment. Suppose that the BP oil field shutdown causes the inflation rate to increase from Inflation Rate 1 to Inflation Rate 2 because firms try to pass on some of the higher input prices to higher output prices. In order to simplify the analysis, assume that full-employment output is constant at FE Output. Full-employment output, or potential output, is the amount of output that the economy produces when all the resources in the economy are efficiently utilized.

If the BP oil field shutdown increases the inflation rate, then the Fed will pursue a tight (anti-inflation) monetary policy which raises interest rates. Higher interest rates would reduce consumption and investment, causing output to fall. An output gap opens up as actual output falls below full-employment output in the short run. In the long run, the output gap will cause the inflation rate to fall back to its initial state. As the inflation rate falls in the long run, the Fed will pursue loose monetary policy and return the economy back to full employment.

A fall in output usually leads to an increase in the unemployment rate as firms cut back on production of goods and services and lay-off workers.

If the BP oil field shutdown leads to an inflation shock, then interest rates will rise, output will fall, and unemployment will increase in the short run.

However, inflation's tyranny does not end there. A higher inflation rate also destroys wealth in terms of stocks and bonds. An increase in the interest rate also reduces the price of stocks and bonds (archived entry: Why Does Bernanke's Small Talk Move Markets?)

1. Financial markets are very sensitive to inflation data. Suppose the Bureau of Labor Statistics reports that the inflation rate increased from 2% to 4%. Why would stock and bond prices fall as soon as the report is released, but before the Fed actually changes any interest rates?

2. The Fed, in its last FOMC meeting on August 8, 2006, kept the federal funds rate unchanged at 5.25%. Could this mean that the Fed does not consider the BP oil field shutdown an inflation shock?

3. Inflation expectations matter. The Fed's inflation-fighting credibility has been strong since Paul Volcker (the Federal Reserve Chairman from 1979 to 1987). Suppose consumers and producers always expect the Fed to return the economy to a target inflation rate--would higher oil prices require the Fed to raise interest rates (or raise them by as much)?

Labels: AD-AS Model, Inflation, Monetary Policy, Unemployment

0 Comments:

Post a Comment

<< Home