Inflation Gone Wild

by William Chiu With an annual inflation rate of 1,600%, Zimbabwe currently holds the world title for fastest-increasing prices. As the late Milton Friedman put it, “Inflation is always and everywhere a monetary phenomenon. To control inflation, you need to control the money supply.” The inflation cure seems simple to understand from a textbook perspective: drastically cut back the money supply in order to lower the expected inflation rate.

With an annual inflation rate of 1,600%, Zimbabwe currently holds the world title for fastest-increasing prices. As the late Milton Friedman put it, “Inflation is always and everywhere a monetary phenomenon. To control inflation, you need to control the money supply.” The inflation cure seems simple to understand from a textbook perspective: drastically cut back the money supply in order to lower the expected inflation rate.Unfortunately, the cure might be worse than the disease. With the current unemployment rate at 80%, drastic cuts in the money supply could increase unemployment and cause a coup d'état before the expected inflation rate falls. The monetary contraction is inevitable if Zimbabwe wishes to tame the inflation monster, and the International Monetary Fund has urged the government to liberalize its exchange rate regime as a means to cushion the unemployment effects.

In order to understand the IMF’s position on Zimbabwe’s exchange rate, we must examine how maintaining an overvalued currency might contribute to soaring inflation, and how floating the currency might provide relief to both inflation and unemployment.

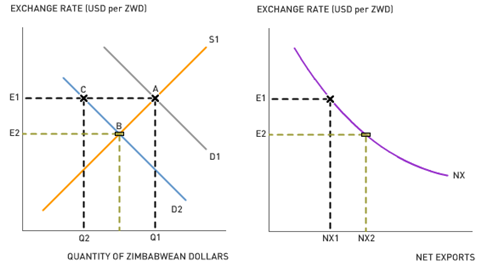

The graph on the left shows the market for Zimbabwean dollars. Assume that the government fixes the exchange rate at E1. A fixed exchange rate is the official value of the currency despite fluctuations in supply and demand. Initially, the official value equals the market value where D1 intersects S1 (point A). Then, due to unsustainable fiscal deficits and government land reforms that usurp private property, foreign investors flee Zimbabwe. Consequently, the demand for Zimbabwean dollars decreases from D1 to D2.

If Zimbabwe were under a floating exchange rate regime, the fall in demand for Zimbabwean dollars would result in the depreciation of the currency from E1 to E2 (point B). But because Zimbabwe’s government insists on a fixed exchange rate regime, the fall in demand for Zimbabwean dollars will cause a surplus of Zimbabwean dollars (Q1 - Q2). At point C, the currency is considered overvalued because the official value is greater than the market value. In order to eliminate downward pressures on the currency, Zimbabwe will instruct its central bank to buy the surplus of Zimbabwean dollars (and sell U.S. dollars), which will return the market to point A. Zimbabwe's central bank will eventually deplete its U.S. dollar reserves as the economy deteriorates from questionable domestic policies, and will borrow U.S. dollars in order to maintain the fixed exchange rate.

If Zimbabwe were under a floating exchange rate regime, the fall in demand for Zimbabwean dollars would result in the depreciation of the currency from E1 to E2 (point B). But because Zimbabwe’s government insists on a fixed exchange rate regime, the fall in demand for Zimbabwean dollars will cause a surplus of Zimbabwean dollars (Q1 - Q2). At point C, the currency is considered overvalued because the official value is greater than the market value. In order to eliminate downward pressures on the currency, Zimbabwe will instruct its central bank to buy the surplus of Zimbabwean dollars (and sell U.S. dollars), which will return the market to point A. Zimbabwe's central bank will eventually deplete its U.S. dollar reserves as the economy deteriorates from questionable domestic policies, and will borrow U.S. dollars in order to maintain the fixed exchange rate.Since the loans are denominated in U.S. dollars, Zimbabwe must make periodic payments in U.S. dollars or face getting cut off from all sources of international capital. Due to disastrous domestic policies, the government has little tax revenue to make those periodic payments, and the only way to service their international debts is to print more money, just as Germany did after World War I. As the central bank expands the money supply to pay international debts, inflation increases, which places additional downward pressure on the Zimbabwean dollar: as foreigners demand less and less of the failing currency, Zimbabwe has to print more and more money, and sooner or later, everything will spin out of control.

One solution is to eliminate the fixed exchange rate regime altogether and allow the Zimbabwean dollar to float freely. If the currency were allowed to float today, its value would fall tremendously, which would stimulate exports and reduce imports. The graph on the right shows that as the exchange rate falls from E1 to E2, net exports increase from NX1 to NX2. A floating exchange rate would boost job creation as the central bank institutes the tough medicine of curing inflation by drastically reducing the money supply.

Discussion Questions

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

Labels: Exchange Rate, Expectations, Inflation, International Economics, Monetary Policy, Quantity Theory of Money, Trade Deficit

15 Comments:

At 3:20 PM, May 02, 2007, Anonymous

said…

Anonymous

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

If the fixed exchange rate regime were eliminated, the size of Zimbabwe’s international debts would increase. Zimbabwe insists on a fixed exchange rate which will cause them to have a surplus of their money because the demand is very low. They would have to pay the U.S. little by little from borrowing just to maintain the fixed exchange rate.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Price controls affect domestic markets because markets can no longer change their prices. They would have to have a fixed price for their products and will not be able to control the costs which are suppose to help people invest their savings in interest accounts if inflation rate was low and stable.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

Hyperinflation may directly contribute to higher unemployment through slower growth rates. Interest rates would be harder to determine but as the article says a floating exchange rate would be helpful in increasing employment and decreasing the money supply.

At 4:14 PM, May 02, 2007, Anonymous

said…

Anonymous

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

• If this were to happen then the Zimbabwe’s international debt would increase. Right now they have a fixed exchange rate so that they have a lot of their money from printing it, if that were to change they would have less money, and their dollar would be worth nothing.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

• They affect them because they have a set price for their product, therefore they cannot rack up the price in order to make more money. There is no price change allowed.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

• It could directly contribute to higher unemployment rates, by allowing the money supply to rise. When they print more money, there is more in circulation, so there is no need for labor when money is present. If they did the floating money like the article suggest, then they can have a lower unemployment rate.

At 8:11 AM, May 04, 2007, jturner672

said…

jturner672

said…

1.If the fized exchange rate regime were eliminated, what would happen to the size of Zimbabwe's dollars? Would it increase or decrease?

If the fixed exchange rate regime were eliminated, the size of Zimbabwe's international debts would increase. Zimababwe has a fixed exchange rate, in order for their money to continue to have worth the exchange rate must stay as it is, if it were to change their money would lose its worth.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Price controls affect domestic markets because these markets have a set price for its product. If the price where to change the costs would become unattainable.

3.This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

Hyperinflation could directly contribute to higher unemployment rates by increasing the money supply. As the article suggests, a floating exchange rate would lower the unemployment rate.

At 6:20 PM, May 06, 2007, cleech991

said…

cleech991

said…

1. If the fixed exchange rate regime were eliminated, the size of Zimbabwe’s international debts in terms of Zimbabweans dollars it would increase. Zimbabwe depends on the fixed-exchange rate because without it their currency value would go down.

2. Price controls affect domestic markets like those of corn, wheat, electricity, and labor because there is a set price for those kinds of products. The price is set and it does not change so there is no chance of making more money.

3. The analysis assumes that Zimbabwe’s reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. Hyperinflation might directly contribute to higher unemployment by increasing the money that is in supply. The article states that floating the currency would help to lower unemployment and inflation.

At 8:24 PM, May 08, 2007, Blake Morlet | Broker

said…

Blake Morlet | Broker

said…

This comment has been removed by a blog administrator.

At 8:26 PM, May 08, 2007, Blake Morlet | Broker

said…

Blake Morlet | Broker

said…

1. If the fixed exchange rate regime were eliminated, Zimbabwe’s international debt would increase tremendously. Zimbabwean dollars would have little demand, and hold little value. The overproduction of currency would produce a surplus in money, and Zimbabwean economy would eventually crash.

2. Price controls cause domestic markets to keep their prices at a certain rate, rather than fluctuating them according to the market at any current time. This could be troublesome for those markets that rely on inflation and price increases to survive.

3. Hyperinflation in Zimbabwe could be potentially devastating; increasing the supply of currency would produce a surplus of currency in circulation, thus raising the level of unemployment. If they went with a floating exchange rate the unemployment rate would decrease substantially.

At 7:32 PM, May 10, 2007, lsivilay

said…

lsivilay

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

Man if this then zimbabwe would be in trouble their international debts would be up to the sky over their heads making their money more worthless than it is now.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Price control effects they demestic market because they are not allowed to increase the price of certain products, for instance they can increase the price on things that is mostly imported it at a fixed rate so u cant change it.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

Hyperinlfation may directly contirbute to higher unemployment because it can increase the money supply more money would be floating around causin the value to drop and a flating exchange rate would help this problem out.

At 8:03 PM, May 13, 2007, Unknown

said…

Unknown

said…

This comment has been removed by the author.

At 8:07 PM, May 13, 2007, Unknown

said…

Unknown

said…

#1

If the fixed exchange rate regime were eliminated then the Zimbabwe debt would increase. This is because when they were printed out so much money before to keep the rate of the money balanced; but now if they eliminate it then they would have surplus of printed money. This would only mean that they debt would be higher than ever because the surplus of printed money would have no value.

#2

When the banks declared that inflation was illegal this would necessary affect the price controls since price controls are the ones that changes the price of products. Yet if they cannot change price, with the inflation being illegal, how can people cope with the rise of products on other countries that have inflation.

#3

Hyperinflation might directly contribute to higher unemployment by having a higher money supply. However, if they followed what the article said about a floating exchange rate, then this could help lower unemployment rate and the inflation rate.

At 8:43 PM, May 13, 2007, Unknown

said…

Unknown

said…

By eliminating a fixed exchange rate regime, the size of Zimbabwe’s international debts would increase in terms of Zimbabwean dollars. This fixed exchange rate regime allows for the money supply to Zimbabwe to increase. Without it the value of their dollar would plummet, resulting in higher debts. Due to the low value, a lower demand of the dollar would result, furthering and increasing their debts.

In each domestic market, a set price is made. This set price allows for profit and cost of inventory. With a price control, the price of product will change resulting in a loss of profit. Eventually, the price control would be to costly resulting in an absence of the market.

Hyperinflation allows for a higher money supply. This increased money supply does not leave a need for employment due to the increased money supply. With a rapid increase of inflation and the money supply, employment would not be needed resulting in an increase in unemployment.

Christopher Guanzon

Econ 201-3039

At 12:14 AM, May 14, 2007, Unknown

said…

Unknown

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? WoulZd it increase or decrease?

If the fixed exchange rate regime were elimated Zimbabwe's debt in terms of Zimbabwean dollars would increase. They would have an excess of their money that they would not be able to exchange for US dollars because if the value Zimbabwean dollars was determined by free floating the value would significantly decrease.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Price controls would effect the domestic market because the prices of the goods would be fixed and unable to flucuate based on the supply and demand within the economy.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

Hyperinflation directly contributes to unemployment because it is a unstable fiscal move that does not encourage economic growth. It floods the economy with more money that does not really have a exchange value.

Rheanna Stone

Econ 201 3039 MSJC

Tony Diab

At 9:03 PM, May 14, 2007, Unknown

said…

Unknown

said…

1. If the fixed exchange rate regime was eliminated, we should see a decrease in the size of Zimbabwe’s international debts. When the Zimbabwean dollar floats freely, the value would fall and stimulate exports and reduce imports. This will boost employment. When exports increase, their net income would increase as well.

2. When price controls are implemented, product prices are set at a constant price. If product suppliers can’t control prices and don’t make enough to keep them in business, they will start leaving. On the other hand, if the prices were too high consumers would have to deplete their savings just to survive.

3. Referring to the Phillips Curve, economists concluded that stagflation was extremely unlikely. However, things work differently since the 1980s. Stagflation does happen. Initially, the official value equals market value for the Zimbabwean dollar. Then, due to unsustainable fiscal deficits and government policies, official value doesn’t equal market value anymore and foreign investors flee Zimbabwe. These foreign investors will take the jobs they created away from Zimbabwe with them.

At 9:06 PM, May 14, 2007, pmackey798

said…

pmackey798

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

If Zimbabwe's current fixed rate regime were to be eliminated the monetary surplus they have created will become worthless. Demand for their currency will decrease causing a surplus of useless currency and forcing the economy to eventually collapse.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Price controls affect domestic markets because set prices do not fluctuate. This will effect the overall supply and demand for goods in this type of market. Financial gain would not be attainable in such an event.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

It is already appearant that hyperinflation has caused an extreme unemployment rate. The BBC News reported back in January of '07 Zimbabwe was already at an 80% unemployment rate due to hyperinflation. It has also been hit with chronic shortages of food and fuel. Hyperinflation has bankrupted the government, left 8 in 10 citizens destitute and decimated the country’s factories and farms.

At 9:37 PM, May 14, 2007, Unknown

said…

Unknown

said…

Discussion Questions

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease?

Once Zimbabwe lifts its exchange rate regime things will get worse before they get better. The value of the Zimbabawean dollar would drop even further. This drop in value would further increase their debt load because the exchange rate for the Zimbabawean dollar vs. US dollar would increase.

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor?

Domestic markets would experience a sharp decline because as the value of the Zimbabwean dollar falls, exports will increase not imports. Price controls will only worsen the problem, ceilings or floors are no good when the curency is worthless.

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment?

As inflation increases, peoples buying power decreases. Employers might not be able to pay the wages that are being demanded, matching that up with an already poor population will cause the aggregate demand curve will shift leftwards causing even more unemployment with an even higher price level.

At 10:24 PM, May 14, 2007, rcampbell242

said…

rcampbell242

said…

1. If the fixed exchange rate regime were eliminated, what would happen to the size of Zimbabwe's international debts in terms of Zimbabwean dollars? Would it increase or decrease? There debt would increase due to decreased demand. The exchange rate would be even more unfavorabl to those in Zimbabwe due to a decreasing dmend due to inflation

2. The central bank has recently declared inflation illegal. How do price controls affect domestic markets like those for corn, wheat, electricity, and labor? Even though there may be an increasing demand in one of these markets, the supply may not be able to meet the demands. If there is a price control, farmers will have less incentive to grow and sell their resources if they can't get a reasonable profit for their efforts

3. This analysis assumes that Zimbabwe's reduction in real GDP is due to domestic policies such as unsustainable fiscal deficits and poor private property rights. How might hyperinflation directly contribute to higher unemployment? Labor wages will be less appealing to workers when there is hyperinflation. There money earned will not be able to sustain them and the money will not be good for investing.

Post a Comment

<< Home