Monetary Policy Reaction Function

by William Chiu The recent financial turmoil and its economic consequences have led the Federal Reserve to aggressively cut the federal funds rate, a key benchmark for all interest rates. In a previous blog post, I explained how the Fed could keep the federal funds rate constant while money demand increases. Now I want to focus on how and why the Federal Reserve reduces the federal funds rate.

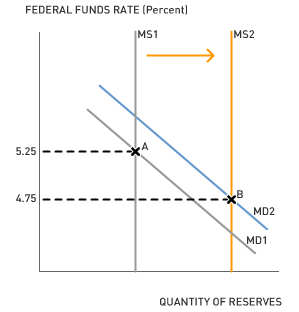

The recent financial turmoil and its economic consequences have led the Federal Reserve to aggressively cut the federal funds rate, a key benchmark for all interest rates. In a previous blog post, I explained how the Fed could keep the federal funds rate constant while money demand increases. Now I want to focus on how and why the Federal Reserve reduces the federal funds rate.The "how" question is easily answered in most economics textbooks. Once the Federal Open Market Committee (FOMC) decides to cut the federal funds rate by 50 basis points, the Open Market Trading Desk purchases the quantity of government securities necessary to reach the new federal funds rate. The graph on the right shows how open-market purchases could lower the federal funds rate from 5.25% to 4.75%.

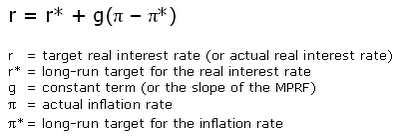

So far, I have stuck to the facts without building a model of the Fed's behavior. Economists sometimes find it convenient to model the behavior of the Fed in terms of a monetary policy reaction function (MPRF). The following is an example of an MPRF from Ben Bernanke and Robert Frank's Principles of Economics:

Of course, the MPRF above is just one example, and there are other examples (such as the Taylor Rule) that are more complex. For teaching purposes, let's just use the simple MPRF.

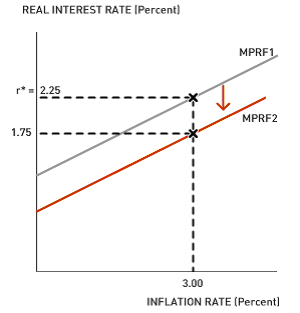

Of course, the MPRF above is just one example, and there are other examples (such as the Taylor Rule) that are more complex. For teaching purposes, let's just use the simple MPRF.In addition to equations, economists often use graphs to depict models. The following graph shows the simple MPRF with the real interest rate on the Y-axis and the inflation rate on the X-axis. Assume a 3% actual and long-run target inflation rate.

The graph shows that a downward shift in the MPRF reduces the actual real interest rate from 2.25% to 1.75% when the actual inflation rate is equal to the initial target inflation rate of 3%. Assuming that the actual inflation rate remains constant in the short run, the shift in the MPRF causes a reduction in the real interest rate, and consequently stimulates investment and consumption. The ultimate goal is to stimulate aggregate demand and prevent the recent financial turmoil from drastically affecting the broader economy.

The graph shows that a downward shift in the MPRF reduces the actual real interest rate from 2.25% to 1.75% when the actual inflation rate is equal to the initial target inflation rate of 3%. Assuming that the actual inflation rate remains constant in the short run, the shift in the MPRF causes a reduction in the real interest rate, and consequently stimulates investment and consumption. The ultimate goal is to stimulate aggregate demand and prevent the recent financial turmoil from drastically affecting the broader economy.Discussion Questions

1. Refer to the simple MPRF equation. A downward shift of the MPRF could be accomplished by a reduction in the long-run target real interest rate (r*). The Fed typically sets r* in line with the equilibrium real interest rate that prevails in the market for loanable funds. Is there reason to believe that the recent financial turbulence has disrupted investment, private saving, public saving, or net capital inflows?

2. A downward shift of the MPRF could also be accomplished by an increase in the long-run target inflation rate. Is there reason to believe that the Fed has increased the long-run target inflation rate?

3. Are there other factors that the Fed should consider in its MPRF?

Labels: Interest Rate, Models, Monetary Policy, Reaction Function, Taylor Rule

0 Comments:

Post a Comment

<< Home