Youth Unemployment in France

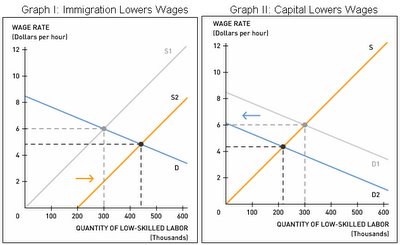

by Brandon FullerTo analyze the effects of the laws, imagine yourself as a French business owner. Suppose a young, inexperienced worker applies for a position with your firm. There's a 50 percent chance she will work hard and a 50 percent chance she will slack off. You might be less willing to take a chance on this inexperienced worker if you face high dismissal costs in the event that she's a slacker. In short, French laws designed to protect workers actually create a disincentive for businesses to hire young, inexperienced workers in the first place. Some argue that this accounts for the sky-high youth unemployment rate in France, which currently stands at 23%--and even higher among immigrant populations.

De Villepin's reform would allow companies to hire workers ages 26 and under on a two-year trial basis. If a young worker excels during the two-year trial, she gets a full-time contract and all of the job protection rights that come with it. But if she doesn't, the employer could let her go at no cost. De Villepin argues that these looser firing restrictions would encourage firms to hire more young workers, driving down the youth unemployment rate.

De Villepin is not the first to propose such reforms. Each time officials proposed youth labor reforms in the past, massive labor union and student protests derailed the legislation--de Villepin can expect more of the same.

1. In addition to job protection measures, France offers comparatively generous unemployment insurance payments and high minimum wages. How do these policies affect the demand for inexperienced youth labor?

2. Would you classify the unemployment created by government legislation such as the minimum wage or firing restrictions as structural, frictional, or cyclical?

3. French officials defend job protection measures, arguing that job security makes workers happier, and therefore more productive. How might job protection measures affect worker productivity?

4. If you were a student in France, would you join the protests or endorse de Villepin?

Topics: Labor market, Unemployment, Structural reforms

Labels: Unemployment