Prop 87, Rent-Seeking, and Confiscatory Taxes

by Chris Makler A number of commentators responded to Paul Romer's post last week on California's Prop 87. Their comments raised a host of interesting issues. It's worth understanding two of them in depth: rent-seeking behavior and confiscatory taxes. Both of these are standard arguments against government taxing and spending activity.

A number of commentators responded to Paul Romer's post last week on California's Prop 87. Their comments raised a host of interesting issues. It's worth understanding two of them in depth: rent-seeking behavior and confiscatory taxes. Both of these are standard arguments against government taxing and spending activity. 1. Rent Seeking

On the topic of subsidies for alternative energy research, Arnold Kling wrote that "once you open up the can of worms of these taxes and subsidies, a lot of rent-seeking crawls out." In the comments to Kling's post, Charles Kruse was less politic:

When Economics Professor Romer says to his students: "Appropriate government subsidies could encourage a socially optimal level of R&D," this is both mealy-mouthed and misleading. Sure, it "could" happen. But consider how the decisions on subsidies will actually get made and the history of previous schemes--not just ethanol but the Lloyd Cutler/Jimmy Carter Synfuels Corporation and other scams. Even the worst ideas to transfer money to the political class can be dressed up with this sort of language.

Kling and Kruse are speaking of rent-seeking behavior--a problem that arises when government, rather than the market, allocates resources. Rent-seekers attempt to obtain artificial payoffs by spending money to curry the favor of elected politicians. What kinds of rent-seeking behavior might occur around Prop 87? Well, when California's government has an extra $4.1 billion burning a hole in its pocket, a lot of people will have an interest in trying to influence how that money gets spent. Firms may devote resources to getting government contracts rather than doing actual energy research. Talented young people, when choosing what career to go into, may go to work for lobbying firms rather than for firms that actually produce things. In short, society will waste resources on the allocation process that would be better used elsewhere.

Consider an example. Suppose you run a company that makes a new kind of solar energy panel. You've already raised $10 million in venture capital to conduct research. Now Prop 87 passes, and the state is looking around for someone to develop a new kind of solar chip. Getting this grant would be worth $50 million to your company. Say you could spend $2 million of your venture capital on campaign donations to elected officials, or perhaps to charities favored by those who are in charge of allocating the Prop 87 funds. If you do this, you figure, you'll increase your chances of landing a government contract by 10%--an expected payoff of $5 million. This may, from your perspective, be a good prospect. Of course, other companies will have the same incentives. Suppose they all start giving money to politicians and charities. In the end, everyone faces the same probability of getting the contract as before--but many valuable person-hours are wasted in lobbying to influence who does the work.

2. Confiscatory Taxes

If the problem of rent-seeking behavior arises because Prop 87 gives California money to spend, the problem of confiscatory taxes arises from levying the tax in the first place. For example, on Harvard economist Greg Mankiw's blog, commenter Harsh Pencil, a contributor to the John Adams blog, writes:

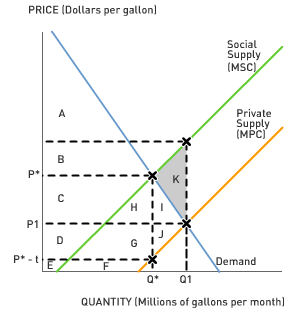

Paul Romer's analysis is basically correct. In effect, there is very little

difference between this proposed tax and simply confiscating a fraction of the oil under the ground in California. (In fact, if the supply curve is vertical, there is no difference.) In many ways, such taxes are the perfect tax: no distortions.But there is a larger issue. There is always a motive for government to confiscate sunk assets to fund things which would otherwise require distorting taxes. Just because these discovered reserves are sunk assets now, doesn't mean they always were. Do we really want to encourage citizens to worry about after-the-fact confiscations?

As Pencil says, the confiscatory tax argument might seem at first blush to fly in the face of the normal tax incidence literature, which suggests that the deadweight loss of a tax is lessened if the supply or demand curves are inelastic. However, recall that the long-run supply of oil is much more elastic than the short-run supply. Therefore, even though California can expect not to affect the amount of oil extracted from its wells over the short term through Prop 87, in the long run, the existence of Prop 87 makes drilling new oil wells in California a less profitable prospect.

Even worse, as Pencil points out, if entrepreneurs in all industries believe that California will impose an after-the-fact tax on any risky venture that goes well, the expected return from taking risks is significantly diminished. This goes well beyond the question of oil. Suppose, for example, that you could invest $1 billion in researching a vaccine for HIV/AIDS. If you succeeded, you could produce the vaccine at a cost of $1 per person. Suppose you thought that if you did succeed, the state of California would pass a law stating that it was immoral for you to charge a price above your marginal cost, and levy a tax on your profits. The fear of such a confiscatory tax could be a huge disincentive to research, and might result in the drug not being developed at all.

Discussion Questions

1. The arguments of rent-seeking and confiscatory taxation can be made against much, if not all, government taxing and spending activity. Are these arguments especially true in the case of Prop 87? Why or why not?

2. The problems highlighted here are legitimate costs associated with Prop 87. However, there are also benefits. How can you compare these costs and benefits to find out whether, on the whole, Prop 87 represents a worthwhile policy?

3. Suppose Prop 87 passes, and you are put in charge of distributing the funds to research institutions. What guidelines could you put in place to reduce rent-seeking behavior?

4. Think about the argument that confiscatory taxes decrease risk-taking activity. This argument relies on the notion of a reputation effect: in particular, that the people of California might develop a reputation for passing confiscatory taxes, which would then have an adverse effect on future entrepreneurs. Is this a credible argument? Do California voters--an ever-changing population--have the ability to commit to not passing confiscatory taxes in the future? By contrast, why would the act of passing Prop 87 make it seem more likely that similar measures would pass in the future? (Remember, the voters of California were the same ones who passed Prop 13, perhaps the most famous government-limiting initiative in U.S. history.) Would it be worse or better if the California legislature passed a confiscatory tax?

Labels: Incentives, Rent Seeking, Taxes