Out-Outsourcing

by Chris Makler One of the biggest economic stories of the past decade has been the practice of outsourcing jobs from the U.S. to India. From the start, it was an enormously profitable idea: American companies could create a “back office” halfway around the world that would work while the folks in the American “front office” slept. Rather than getting 8 or 10 hours per day of productive work, companies could be productive around the clock.

One of the biggest economic stories of the past decade has been the practice of outsourcing jobs from the U.S. to India. From the start, it was an enormously profitable idea: American companies could create a “back office” halfway around the world that would work while the folks in the American “front office” slept. Rather than getting 8 or 10 hours per day of productive work, companies could be productive around the clock.Of course, American companies couldn’t all just set up shop in India—the fixed costs are too great. So Indian entrepreneurs began founding companies to provide back-office services to American firms. One of these was Infosys Technologies. Now, the New York Times reports, Infosys and its Indian rivals are opening back offices of their own in Brazil, Chile, Uruguay, the Czech Republic, Mexico—and even the United States. The article states:

In a poetic reflection of outsourcing’s new face, Wipro’s chairman, Azim Premji, told Wall Street analysts this year that he was considering hubs in Idaho and Virginia, in addition to Georgia, to take advantage of American “states which are less developed.”In other words, globalization has come full circle: now you can work in Georgia for an Indian company providing services for an American company.

Discussion Questions

1. Consider a company in Silicon Valley that outsources some of its work to Infosys in India, which in turn outsources some of its work to an office complex in Idaho. Suppose the project is handled by one programmer in each location, and suppose that each programmer is equally talented. In all probability, the wages earned by each programmer are different. What explains this difference?

2. Some jobs, like computer programming, are easily outsourced. Others, like providing haircuts or construction, are not. What effect do you think an increase in outsourcing would have on the wages of computer programmers, barbers, and construction workers? What about the relative prices of software, haircuts, and housing?

3. The increase in outsourcing over the past decade or so is what economists call a disequilibrium phenomenon. Disequilibrium occurs when there is a rapid change in the way things are done—for example, a rapid shift in a demand or supply curve—and prices and quantities have not yet fully adjusted to their new equilibrium levels. What do you think the new equilibrium will look like? What impact do those expectations have on the choices you need to make in college—such as what to major in, or what companies you should try to get a summer internship with?

Labels: Globalization, India, Labor

The Federal Open Market Committee (

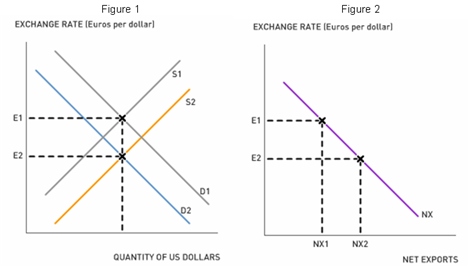

The Federal Open Market Committee ( A depreciation of the U.S. currency will make U.S. exports relatively inexpensive for foreigners while making imports from foreign countries relatively expensive for Americans. A decrease in the interest rate causes an increase in net exports and reduces the size of the U.S. trade deficit. Figure 2 shows the relationship between the exchange rate and net exports. Since net exports are a component of total spending in the U.S. economy, the Fed's rate cut provides two boosts to aggregate spending: (1) the rate cut stimulates consumption and investment because the cost of borrowing decreases; and (2) the rate cut stimulates net exports due to U.S. dollar depreciation. By cutting the target fed funds rate, the Fed intends to prop up spending and growth at a time when tightening credit conditions threaten to slow or reverse the growth of economic output.

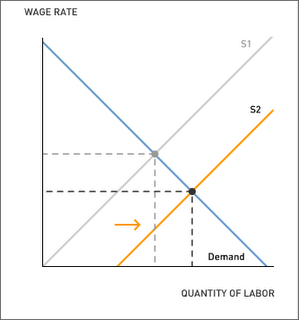

A depreciation of the U.S. currency will make U.S. exports relatively inexpensive for foreigners while making imports from foreign countries relatively expensive for Americans. A decrease in the interest rate causes an increase in net exports and reduces the size of the U.S. trade deficit. Figure 2 shows the relationship between the exchange rate and net exports. Since net exports are a component of total spending in the U.S. economy, the Fed's rate cut provides two boosts to aggregate spending: (1) the rate cut stimulates consumption and investment because the cost of borrowing decreases; and (2) the rate cut stimulates net exports due to U.S. dollar depreciation. By cutting the target fed funds rate, the Fed intends to prop up spending and growth at a time when tightening credit conditions threaten to slow or reverse the growth of economic output. So what are the sources of the farm labor shortages in the U.S. and Britain?

So what are the sources of the farm labor shortages in the U.S. and Britain?

As

As

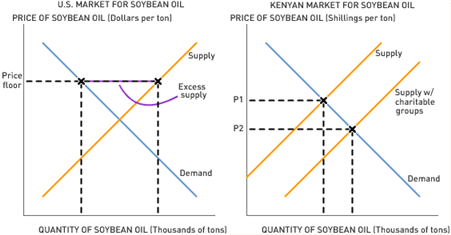

The charitable organizations represent additional sellers in the Kenyan market for soybean oil. The supply of soybean oil in the Kenyan market rises, leading to a reduction in soybean oil prices. The lower price of soybean oil can impact local farmers in a couple of different ways. If a local farmer produces soybeans, the decrease in price obviously reduces her profit margin and directly lowers her income. However, the impact need not be so direct. A local farmer producing a substitute for soybean oil, such as sunflower seed oil, will see the demand for his product decline as well due to the decrease in soybean oil prices.

The charitable organizations represent additional sellers in the Kenyan market for soybean oil. The supply of soybean oil in the Kenyan market rises, leading to a reduction in soybean oil prices. The lower price of soybean oil can impact local farmers in a couple of different ways. If a local farmer produces soybeans, the decrease in price obviously reduces her profit margin and directly lowers her income. However, the impact need not be so direct. A local farmer producing a substitute for soybean oil, such as sunflower seed oil, will see the demand for his product decline as well due to the decrease in soybean oil prices. The result is the same—lower income for Kenyan farmers producing products that somehow compete with the subsidized commodities that the charitable groups sell to raise funds. Keep in mind that the percentage of the Kenyan population employed in agriculture is much higher than in the United States.

The result is the same—lower income for Kenyan farmers producing products that somehow compete with the subsidized commodities that the charitable groups sell to raise funds. Keep in mind that the percentage of the Kenyan population employed in agriculture is much higher than in the United States.

Where smoothly functioning markets exist, they generally do an efficient job of answering the fundamental economic questions—what gets produced, how it gets produced, and who receives it. Not everyone will be happy with those answers, but there is efficiency in the sense that to make any person better off would require making at least one other person worse off.

Where smoothly functioning markets exist, they generally do an efficient job of answering the fundamental economic questions—what gets produced, how it gets produced, and who receives it. Not everyone will be happy with those answers, but there is efficiency in the sense that to make any person better off would require making at least one other person worse off.