Global warming is in the news a lot lately, not least because of "

An Inconvenient Truth," a documentary about Al Gore's position on the subject. Ten years ago, the discussion about global warming centered on whether it exists; a broad scientific consensus now seems to have concluded that it does. Therefore, the question now under discussion is: What should we do about it?

Bjorn Lomborg's answer is:

not much. Lomborg, an associate professor of statistics at the University of Aarhus in Denmark and the author of "The Skeptical Environmentalist," organized a conference called the "

Copenhagen Consensus." In 2004 he invited a number of notable economists, including four Nobel laureates, to discuss the greatest challenges facing humanity--and to evaluate the relative costs of meeting them. A few weeks ago, he followed this up with a group of U.N. ambassadors. To each group he posed the classic economists' question: in a world of scarcity, what is the best use of resources? A more prosaic way of posing the same question: given a certain amount of money to "do good" with--say, $50 billion--what is the most effective use of that money?

Both the economists and the U.N. ambassadors ranked combating climate change at the bottom of the list. Their logic was that the other potential uses of resources--providing sanitation to combat malaria, giving relief to post-conflict regions to help reduce the risk of repeat conflict, etc.--had a much higher benefit than directing resources to combat climate change. For example, according to Lomborg, the panels found that:

Forty dollars of good would be achieved for every dollar spent on HIV/Aids prevention. In other words, a dollar's worth of condoms in the right place would bring benefits an Aids-affected community would value at $40…Spending the world's limited resources combating climate change would achieve good, but would cost more than it would achieve. That money could be better spent elsewhere.

Lomborg is, of course, right that resources are scarce, and that the costs and benefits of any action should be carefully considered. He may even be right that in monetary terms, other, more immediate projects have a bigger bang for the buck. But there is a valid counterargument.

On the

Environmental Protection Agency's web site on global warming, there's a section designed

for kids. It poses the problem of climate change as follows:

Sometimes little things can turn into big things. Think about brushing your teeth. If you don't brush for one day, chances are nothing bad will happen. But if you don't brush your teeth for one month, you may develop a cavity. It's the same thing with global temperatures. If temperatures rise above normal levels for a few days, it's no big deal – the Earth will stay more or less the same. But if temperatures continue to rise over a longer period of time, then the Earth may experience some problems.

Lomborg's argument, in short, comes down to this: on any given day, there are better things to do than go to the dentist. The appropriate counterargument is: yes, but if you never go to the dentist, your teeth rot.

1. Apart from global warming, what do you think is the single most important issue facing the nation and the world? If you had $50 billion to spend on that and on measures to combat global warming, how would you allocate those resources?

2. One of the necessary conditions of examining climate change is developing some way of comparing current costs and future benefits. Economists usually do this by discounting--that is, multiplying future benefits by a factor less than one to calculate the "present value" of those benefits today. How would a change in this discount factor affect the relative merits of different programs? If the discount factor were higher (closer to 1), would combating global warming have had a higher ranking by the Copenhagen Consensus? How would you compare the costs of combating global warming with the benefits?

3. One of the greatest challenges to the U.S. economy is the skyrocketing cost of health care. As with global warming, part of the health care challenge is that we have bad habits--like eating burgers and fries--that, added up over the course of a lifetime, result in serious conditions like heart disease. However, the immediate taste benefit of eating any particular burger may be much greater than the incremental health cost of eating that burger. Similarly, for you, the benefits of driving to work on any given day outweigh the costs to the environment--but when taken in total, the costs of everyone driving to work every day for decades on end mount up to serious problems. What methods do people use to develop healthier lifestyles? Could those methods be applied to the problem of global warming?

Labels: Environment

In Chinese mythology, dragons can bring prosperity or destruction to villages and empires. China currently faces two dragons: the trade surplus that brings prosperity to Chinese manufacturers and urban workers, and inflation, which threatens China's price stability. Bloomberg reports that China's trade surplus might be fueling China's inflation problems.

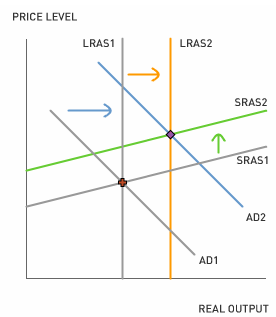

In Chinese mythology, dragons can bring prosperity or destruction to villages and empires. China currently faces two dragons: the trade surplus that brings prosperity to Chinese manufacturers and urban workers, and inflation, which threatens China's price stability. Bloomberg reports that China's trade surplus might be fueling China's inflation problems. 1. China maintains a relatively fixed nominal exchange rate between the yuan and the U.S. dollar (nominal exchange rate = 8 yuan per U.S. dollar). The real exchange rate is the nominal exchange rate times the ratio between the U.S. price level and the Chinese price level. The real exchange rate also represents the cost of U.S. goods and services relative to Chinese goods and services. How does an increase in China's inflation rate affect the real exchange rate?

1. China maintains a relatively fixed nominal exchange rate between the yuan and the U.S. dollar (nominal exchange rate = 8 yuan per U.S. dollar). The real exchange rate is the nominal exchange rate times the ratio between the U.S. price level and the Chinese price level. The real exchange rate also represents the cost of U.S. goods and services relative to Chinese goods and services. How does an increase in China's inflation rate affect the real exchange rate?