Monetary Policy Reaction Function

by William Chiu The recent financial turmoil and its economic consequences have led the Federal Reserve to aggressively cut the federal funds rate, a key benchmark for all interest rates. In a previous blog post, I explained how the Fed could keep the federal funds rate constant while money demand increases. Now I want to focus on how and why the Federal Reserve reduces the federal funds rate.

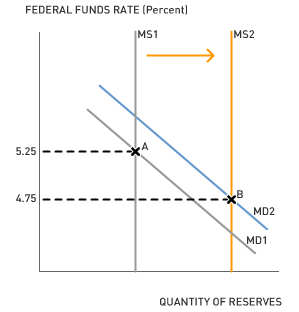

The recent financial turmoil and its economic consequences have led the Federal Reserve to aggressively cut the federal funds rate, a key benchmark for all interest rates. In a previous blog post, I explained how the Fed could keep the federal funds rate constant while money demand increases. Now I want to focus on how and why the Federal Reserve reduces the federal funds rate.The "how" question is easily answered in most economics textbooks. Once the Federal Open Market Committee (FOMC) decides to cut the federal funds rate by 50 basis points, the Open Market Trading Desk purchases the quantity of government securities necessary to reach the new federal funds rate. The graph on the right shows how open-market purchases could lower the federal funds rate from 5.25% to 4.75%.

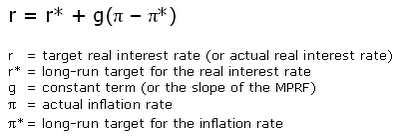

So far, I have stuck to the facts without building a model of the Fed's behavior. Economists sometimes find it convenient to model the behavior of the Fed in terms of a monetary policy reaction function (MPRF). The following is an example of an MPRF from Ben Bernanke and Robert Frank's Principles of Economics:

Of course, the MPRF above is just one example, and there are other examples (such as the Taylor Rule) that are more complex. For teaching purposes, let's just use the simple MPRF.

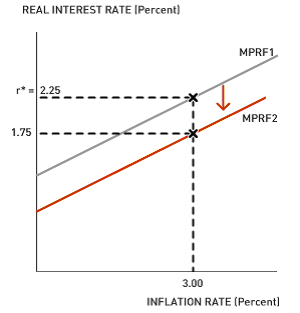

Of course, the MPRF above is just one example, and there are other examples (such as the Taylor Rule) that are more complex. For teaching purposes, let's just use the simple MPRF.In addition to equations, economists often use graphs to depict models. The following graph shows the simple MPRF with the real interest rate on the Y-axis and the inflation rate on the X-axis. Assume a 3% actual and long-run target inflation rate.

The graph shows that a downward shift in the MPRF reduces the actual real interest rate from 2.25% to 1.75% when the actual inflation rate is equal to the initial target inflation rate of 3%. Assuming that the actual inflation rate remains constant in the short run, the shift in the MPRF causes a reduction in the real interest rate, and consequently stimulates investment and consumption. The ultimate goal is to stimulate aggregate demand and prevent the recent financial turmoil from drastically affecting the broader economy.

The graph shows that a downward shift in the MPRF reduces the actual real interest rate from 2.25% to 1.75% when the actual inflation rate is equal to the initial target inflation rate of 3%. Assuming that the actual inflation rate remains constant in the short run, the shift in the MPRF causes a reduction in the real interest rate, and consequently stimulates investment and consumption. The ultimate goal is to stimulate aggregate demand and prevent the recent financial turmoil from drastically affecting the broader economy.Discussion Questions

1. Refer to the simple MPRF equation. A downward shift of the MPRF could be accomplished by a reduction in the long-run target real interest rate (r*). The Fed typically sets r* in line with the equilibrium real interest rate that prevails in the market for loanable funds. Is there reason to believe that the recent financial turbulence has disrupted investment, private saving, public saving, or net capital inflows?

2. A downward shift of the MPRF could also be accomplished by an increase in the long-run target inflation rate. Is there reason to believe that the Fed has increased the long-run target inflation rate?

3. Are there other factors that the Fed should consider in its MPRF?

Labels: Interest Rate, Models, Monetary Policy, Reaction Function, Taylor Rule

It’s 85 degrees and sunny on this October day in the Bay Area, and this morning’s review of the

It’s 85 degrees and sunny on this October day in the Bay Area, and this morning’s review of the

Next week, we can expect the winner to be announced for this year's Nobel Prize in Economics. (Last year, the Aplia Econ Blog posted an

Next week, we can expect the winner to be announced for this year's Nobel Prize in Economics. (Last year, the Aplia Econ Blog posted an  Robert Frank devoted

Robert Frank devoted  I love Radiohead. Really, love. I still remember sitting in my car in the record store parking lot with one of my best friends, listening to their fourth record,

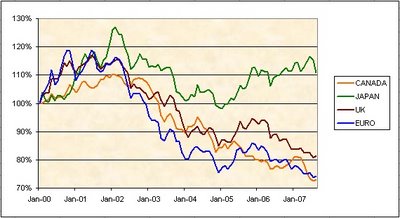

I love Radiohead. Really, love. I still remember sitting in my car in the record store parking lot with one of my best friends, listening to their fourth record,  At the consumer level, it's fairly simple—a weaker dollar means our purchasing power is weaker when buying foreign goods. Effectively, imported goods become more expensive, since the U.S. dollar can buy fewer euros, for example. However, there is another side to this story, because it also means that U.S. goods are cheaper to foreign consumers. This is one of those things that sounds bad, but depending on who you are, can actually be quite good. If you are a U.S. firm, a weaker dollar can be beneficial because it enables foreign consumers to buy more of your products.

At the consumer level, it's fairly simple—a weaker dollar means our purchasing power is weaker when buying foreign goods. Effectively, imported goods become more expensive, since the U.S. dollar can buy fewer euros, for example. However, there is another side to this story, because it also means that U.S. goods are cheaper to foreign consumers. This is one of those things that sounds bad, but depending on who you are, can actually be quite good. If you are a U.S. firm, a weaker dollar can be beneficial because it enables foreign consumers to buy more of your products. The value of the U.S. dollar (USD) is falling against a number of foreign currencies, including the Canadian dollar (CAD), also known as the loonie. As the dollar weakens against the loonie, imports from Canada, including illegal drugs like marijuana, become more expensive. As American dope-smokers get priced out of the market for high-quality Canadian marijuana, they increasingly turn to lower-quality Mexican varieties and, as this

The value of the U.S. dollar (USD) is falling against a number of foreign currencies, including the Canadian dollar (CAD), also known as the loonie. As the dollar weakens against the loonie, imports from Canada, including illegal drugs like marijuana, become more expensive. As American dope-smokers get priced out of the market for high-quality Canadian marijuana, they increasingly turn to lower-quality Mexican varieties and, as this  For many people, the pain of losing $500 outweighs the pleasure of gaining $500. As Austan Goolsbee points out in a recent

For many people, the pain of losing $500 outweighs the pleasure of gaining $500. As Austan Goolsbee points out in a recent