Should the Government Tax Consumption or Income?

by Chris Makler Robert Frank devoted his most recent New York Times column to the idea of shifting taxes from income to consumption. It’s not a new idea, and it’s one that many economists of various political stripes agree on.

Robert Frank devoted his most recent New York Times column to the idea of shifting taxes from income to consumption. It’s not a new idea, and it’s one that many economists of various political stripes agree on.Right now, the amount of tax you pay is based on your income. The more you earn, the more you pay in taxes on each additional dollar earned—the “marginal income tax rate.” One important argument against the income tax is that it penalizes savings. Consider an unmarried taxpayer—let’s call her Sally—who is in the 25% tax bracket. (For an individual, that means earning between about $30,000 and $70,000 per year.)

Now suppose that Sally gets a $10,000 raise. She faces a marginal tax rate of 25%, so that $10,000 raise is really a $7,500 raise at most. If she saves that money at 6% interest, the additional income will also be taxed at 25%, bringing it down to about 4.5% per year—barely more than inflation. It would take her eight years to earn enough interest to get her bank account back to the initial “raise” of $10,000.

Now consider a different tax system: one in which Sally’s consumption is taxed rather than her income. That is, suppose she would owe exactly $0 in taxes on any money she saves. This means she could put away the entire $10,000 raise and let it accrue interest at the full rate of 6% per year. After eight years, she would have nearly $16,000 in the bank. Such a system would clearly encourage Americans to save more money.

The fact that a consumption tax would encourage savings by not taxing saved money has earned it the nickname of the “unlimited savings allowance.”

Discussion Questions

1. If one were choosing between a pure income tax and a pure consumption tax, the former would be more likely to encourage consumption, while the latter would be more likely to encourage savings. Which of these—consumption or savings—would be more beneficial to the economy as a whole? Why?

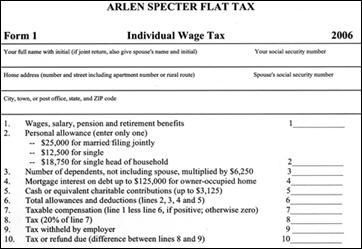

2. Frank suggests a highly progressive consumption tax (i.e., the marginal tax rate would rise as consumption increased). He even does a thought experiment with a 100% marginal tax rate on consumption beyond a certain level. A famous tax proposal by economists Bob Hall and Alvin Rabushka would levy a “flat tax” on consumption. How would you compare these two proposals? What are the pros and cons of each?

3. Frank is famous for his belief that because people care about “keeping up with the Joneses,” consumption actually has a negative externality associated with it. If that is true, is a consumption tax in reality a kind of Pigovian tax?

4. Two of the guiding normative principles by which many people judge tax systems are the ability to pay principle (briefly, that the rich should pay more in taxes) and the benefits received principle (briefly, that if taxes are used to fund a public good, those who benefit the most from the good should pay the taxes). Does Frank’s proposal follow these principles? Why or why not?