The Demand for Natural Light

by Ryan Knapp I once participated in a blind taste test involving eight light beers. Faced with eight un-marked cups, I was certain I’d prefer the priciest, and presumably classiest, light beer in the field. Alas, I chose Natural Light. For me, the cheap and down-market “Natty Light” is the choicest light beer on offer. But people who have (or think they have) a more refined palate gladly pay for a more expensive option like Heineken or Bud Light.

I once participated in a blind taste test involving eight light beers. Faced with eight un-marked cups, I was certain I’d prefer the priciest, and presumably classiest, light beer in the field. Alas, I chose Natural Light. For me, the cheap and down-market “Natty Light” is the choicest light beer on offer. But people who have (or think they have) a more refined palate gladly pay for a more expensive option like Heineken or Bud Light.With the economic downturn, however, cash-strapped beer drinkers appear to be switching to cheaper beers like Busch, Natural Light, and Keystone. As average incomes declined in the United States, sales of these cheaper options have increased substantially. Meanwhile, sales of ‘premium’ brands like Budweiser and Heineken were reportedly down 18% and 14% respectively from a year ago in July 2008.

Discussion Questions

1. If, other things being equal, a reduction in average income leads to an increase in the demand for Natural Light, what type of good is “Natty Light”? If, during the same period, the demand for Bud Light declines, what type of good is Bud Light?

2. What additional information would be useful if you were trying to use changes in average income and beer sales to determine whether a particular brand of beer was a normal or inferior good?

3. What strategy might a large beer company adopt to protect itself from an economic downturn?

4. Information Resources, Inc. reports that sales of Bud Light were down about 7% from a year ago in July 2008. Let’s assume that the price of Bud Light is fixed, so that the percentage decrease in sales is the same as the percentage decrease in the quantity of Bud Light demanded. Assume that personal income per capita in the United States declined by about 3.4% over the same period. Keeping in mind that factors other than income probably affected Bud Light sales over this period, use these numbers to come up with a rough estimate of the income elasticity for Bud Light. Is the income elasticity of demand for Bud Light elastic or inelastic? Would you characterize Bud Light as a luxury or a necessity?

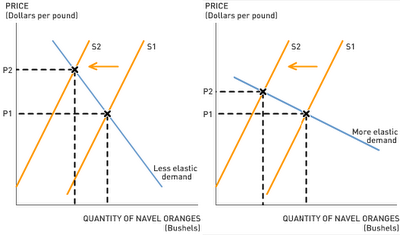

Labels: Demand, Elasticity