Economics of Flu Vaccines

by Colleen O'Rourke In the last few months, the H1N1 influenza virus, or “swine flu,” has been dominating the news, and many people are worried about access to flu vaccines or “flu shots.” (That is, unless you work for Goldman Sachs, who got first dibs. But don’t they always?)

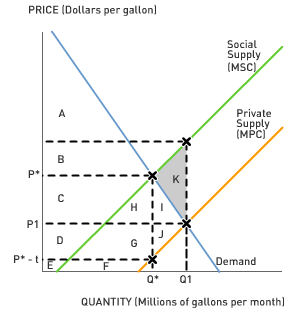

In the last few months, the H1N1 influenza virus, or “swine flu,” has been dominating the news, and many people are worried about access to flu vaccines or “flu shots.” (That is, unless you work for Goldman Sachs, who got first dibs. But don’t they always?) Unlike other viral diseases, flu viruses constantly mutate, or change into new “strains.” A vaccine that works to protect against a specific strain one year will probably not work to prevent against a new strain the next year. Because of this, hundreds of hours of lab work are devoted each year to identifying specific flu strains, developing a vaccine against them, and then producing that vaccine in large enough quantities to distribute to the population.

This year, the efforts of flu vaccination labs have been split, with only some of the labs producing vaccines against the “regular” flu, and the rest working on vaccines against the specific H1N1 swine flu strain. Because of this, the supplies of both of these types of vaccines are greatly reduced this year in comparison to previous years.

Given the scarcity of both traditional and swine flu vaccines, how should the existing vaccine be distributed? If the goal is to maximize societal health, the flu vaccine should first be given to those whose health would benefit from it the most, who are people at risk of complications and death from the flu, including young children, the elderly, and the immuno-compromised. On the other hand, if the goal is to minimize the cost of the flu to an economy, the most productive and important members of society should get the first vaccine.

To a certain extent, extreme examples on both ends are small in number and easy to take care of. For example, health care employees are at greater risk of contracting any disease and, consequently, of infecting those whose health is vulnerable. So it’s clear they should be the first in line to get the vaccine. But what about people who don’t have such critical jobs (and keep in mind that you probably qualify as one of these people)? This topic relates not only to the health of the economy, but your personal health as well.

Discussion Questions:

1. Do you think that the goal of those who control flu vaccine policy should be to get the best health outcome, to minimize the cost to GDP, or some combination of the two? What public health policies would achieve your preferred policy goal?

2. Assume that society does want to maximize productivity in dollar terms rather than health outcomes. Now, take into consideration the fact that those who do get sick might require expensive medical treatment, the cost of which will be partially borne by society. How does this alter the analysis of who should receive the vaccines?

3. Economists often are fond of markets as allocation mechanisms because the forces of supply and demand determine a price that allocates goods to those who are willing to pay for them the most. How would a market for flu vaccine work? Why is it different from a market for non-life-affecting goods and services, like books or cars?

4. Firms (especially ones with high-productivity employees) value their employees’ health. It is estimated that that the total yearly economic cost of the flu in the U.S. is over $80 billion. Many companies have started to recognize this and have made attempts to protect their own economic interest by paying for or providing flu vaccines to their employees. As a result, employees who otherwise may not have been vaccinated (since the unsubsidized cost exceeds the expected health benefit) are more likely to accept the free vaccine. Is this efficient? Is it equitable?

5. Vaccines have a limited shelf-life – that is, they can only be used for a particular period of time if they are to be effective. For this reason, the timing of development, production, and distribution of flu vaccines in the United States is largely based on the pattern of the flu season in previous years. Go to Google Flu Trends to see a graph comparing the incidence of flu activity in the United States this year with previous years. How does the current flu season differ from previous years? If you were in charge of setting production policy for 2010, what might you change in order to produce the correct amount of vaccine for each strain of flu at the appropriate time?

Labels: Costs of Production, Health Care, Market Failure, Tradeoffs

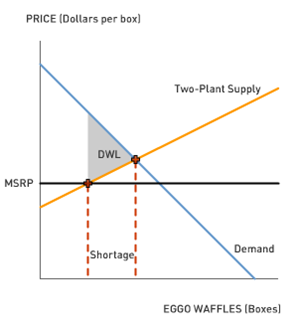

It’s hard to miss the barren shelves in grocery stores due to a pending Eggo Waffle shortage. The recent run on the popular breakfast food is one of the few times when a very clear-cut piece of microeconomics hits home enough to capture the attention of people without an economics background. What fascinates me the most about this story is how people with no interest in economics still have the shortage on the tips of their tongues. I believe there are two different microeconomics concepts at play here: one covered in nearly every introductory economics class and the other a deeper assumption that deserves more discussion than it normally gets.

It’s hard to miss the barren shelves in grocery stores due to a pending Eggo Waffle shortage. The recent run on the popular breakfast food is one of the few times when a very clear-cut piece of microeconomics hits home enough to capture the attention of people without an economics background. What fascinates me the most about this story is how people with no interest in economics still have the shortage on the tips of their tongues. I believe there are two different microeconomics concepts at play here: one covered in nearly every introductory economics class and the other a deeper assumption that deserves more discussion than it normally gets.

With significant contributions and analysis from Kasie R. Jean.

With significant contributions and analysis from Kasie R. Jean.

In an important scene from the 1999 movie American Beauty, two characters—Jane and Ricky—watch

In an important scene from the 1999 movie American Beauty, two characters—Jane and Ricky—watch  It’s 85 degrees and sunny on this October day in the Bay Area, and this morning’s review of the

It’s 85 degrees and sunny on this October day in the Bay Area, and this morning’s review of the